Mutual Funds for US Stocks: A Comprehensive Guide

author:US stockS -

Are you considering investing in U.S. stocks but unsure where to start? Mutual funds could be the perfect solution for you. These investment vehicles pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. In this article, we'll explore the benefits of mutual funds for U.S. stocks, how to choose the right one, and provide some key tips for successful investing.

Understanding Mutual Funds

A mutual fund is a type of collective investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. The money is managed by a professional fund manager who invests the money on behalf of the investors. Mutual funds are available in various types, including:

- Stock Funds: Invest primarily in stocks, aiming to grow capital over the long term.

- Bond Funds: Invest in bonds, which provide income through interest payments.

- Balanced Funds: Invest in a mix of stocks and bonds, offering a balance between growth and income.

Benefits of Mutual Funds for U.S. Stocks

Investing in U.S. stocks through mutual funds offers several advantages:

- Diversification: Mutual funds allow you to invest in a wide range of stocks, reducing your risk compared to investing in a single stock.

- Professional Management: Fund managers have the expertise and experience to make informed investment decisions on your behalf.

- Accessibility: Mutual funds are available to investors with small amounts of money, making them accessible for those just starting out.

- Convenience: Mutual funds are easy to buy, sell, and manage, allowing you to invest and reinvest your money with ease.

How to Choose the Right Mutual Fund

When selecting a mutual fund for U.S. stocks, consider the following factors:

- Investment Objective: Ensure the fund's objective aligns with your investment goals, whether it's long-term growth or income generation.

- Fund Performance: Review the fund's historical performance, but remember that past performance is not always indicative of future results.

- Expense Ratio: Lower expense ratios are typically better, as they mean more of your investment is being used for growth rather than fees.

- Fund Manager: Look for a fund manager with a strong track record and a good understanding of the U.S. stock market.

Key Tips for Successful Investing in Mutual Funds

To maximize your investment in mutual funds for U.S. stocks, consider the following tips:

- Start Early: The sooner you start investing, the more time your money has to grow.

- Stay Diversified: Diversify your portfolio to reduce risk.

- Review Your Investments Regularly: Keep an eye on your investments and make adjustments as needed.

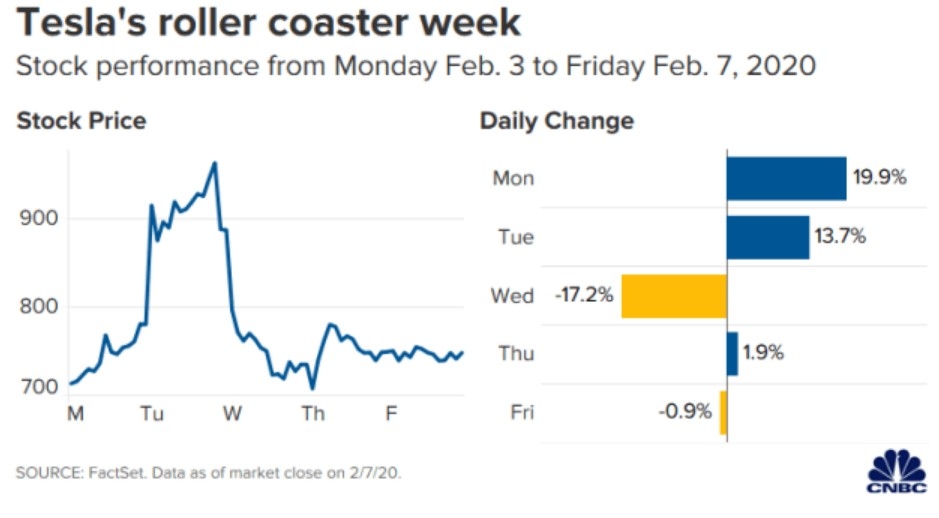

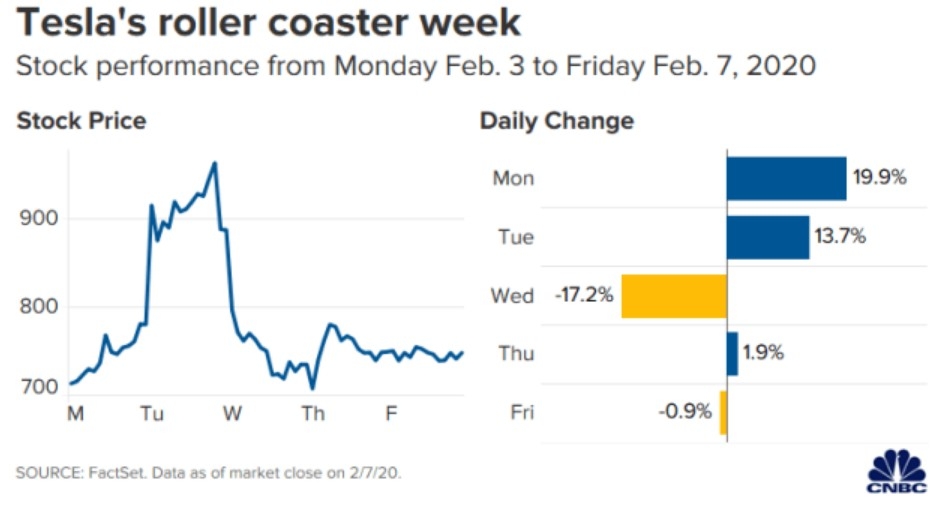

- Avoid Emotional Investing: Don't let emotions drive your investment decisions.

Case Study: Vanguard 500 Index Fund

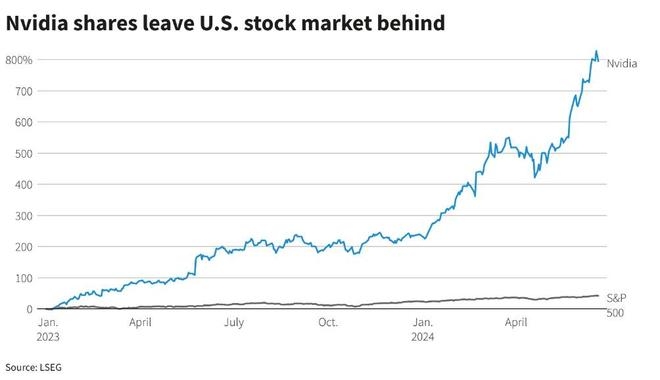

One popular mutual fund for U.S. stocks is the Vanguard 500 Index Fund (VFINX), which tracks the performance of the S&P 500 index. This fund has been a favorite among investors for its low expense ratio and strong performance over the long term. As of December 2021, the fund had an expense ratio of 0.04% and an average annual return of 10.2% over the past 10 years.

In conclusion, mutual funds are an excellent way to invest in U.S. stocks, providing diversification, professional management, and accessibility. By carefully selecting a mutual fund and following some key tips, you can build a successful investment portfolio and achieve your financial goals.

us stock market today