Large Cap US Stocks: A Risky Asset?

author:US stockS -

In the vast landscape of the financial market, large-cap US stocks have long been perceived as a safe haven for investors. These stocks, representing the largest companies in the United States, are often considered to be less volatile and more stable compared to their smaller counterparts. However, is this perception accurate, or are large-cap US stocks actually a risky asset? Let's delve into this debate and examine the factors that make these stocks potentially risky.

Understanding Large Cap US Stocks

Large-cap US stocks refer to the shares of companies with a market capitalization of over $10 billion. These companies are typically well-established, dominant players in their respective industries. Some of the most renowned large-cap US stocks include Apple, Microsoft, and Google's parent company, Alphabet.

The Perception of Safety

One of the primary reasons why large-cap US stocks are often viewed as safe investments is their historical performance. These companies have a proven track record of profitability and stability, which has led to a general belief that investing in them is a low-risk endeavor. However, this perception might be misleading.

Factors Making Large Cap US Stocks Risky

Market Volatility: While large-cap stocks may be less volatile than smaller ones, they are not immune to market downturns. Economic factors, geopolitical events, and global crises can impact the performance of even the largest companies.

Economic Downturns: Large-cap companies may be more resilient than smaller ones during economic downturns, but they are not immune to the impact. For example, during the 2008 financial crisis, many large-cap stocks experienced significant declines in their share prices.

Regulatory Changes: Large-cap companies are subject to stringent regulations, and changes in these regulations can have a significant impact on their profitability. For instance, the introduction of new regulations in the tech industry could potentially impact the performance of large-cap tech stocks.

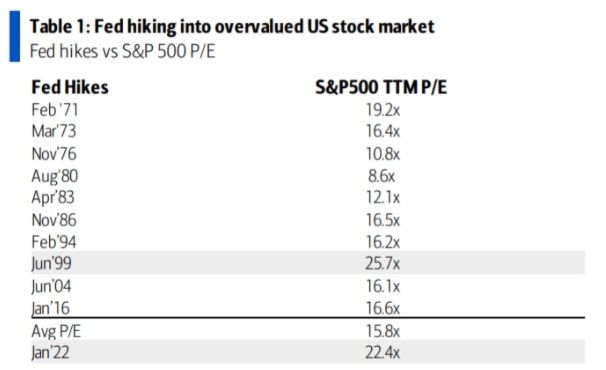

Overvaluation: Sometimes, large-cap stocks can become overvalued due to market euphoria or excessive investor optimism. This can lead to a sudden correction in their share prices, as was witnessed during the dot-com bubble in the late 1990s.

Case Studies

To illustrate the potential risks associated with large-cap US stocks, let's consider two case studies:

Tech Industry: The tech industry has been a significant driver of the US stock market's growth over the past two decades. However, companies like Facebook (now Meta) and Twitter have faced criticism and regulatory scrutiny, which has impacted their share prices.

Energy Sector: The energy sector has been hit hard by the fluctuating oil prices. Large-cap energy companies like ExxonMobil have seen their share prices decline during periods of low oil prices.

Conclusion

In conclusion, while large-cap US stocks may appear safe due to their historical performance and market capitalization, they are not without risk. Investors need to be aware of the potential risks associated with these stocks and conduct thorough research before making investment decisions. By understanding the factors that can impact these stocks, investors can better manage their risk and make informed investment choices.

us stock market today