Is the US Stock Market Overpriced? A Comprehensive Analysis

author:US stockS -

Introduction:

In recent years, the US stock market has seen an unprecedented rise, prompting many investors to question whether it's currently overvalued. This article delves into the factors contributing to the current market conditions, examines key indicators, and analyzes the potential risks and rewards for investors.

Historical Context:

Historically, the US stock market has experienced cycles of overvaluation and undervaluation. For instance, the dot-com bubble of the late 1990s and the 2008 financial crisis were periods when the market was significantly overpriced. However, after these corrections, the market recovered and continued to grow.

Current Market Conditions:

Today, the US stock market is facing several challenges that could indicate it's overpriced. Here are some of the key factors:

1. High Valuation Metrics:

One of the primary indicators of an overvalued market is the price-to-earnings (P/E) ratio. Currently, the S&P 500 has a P/E ratio of around 22, which is higher than its long-term average of around 16. This suggests that stocks are overvalued relative to their earnings.

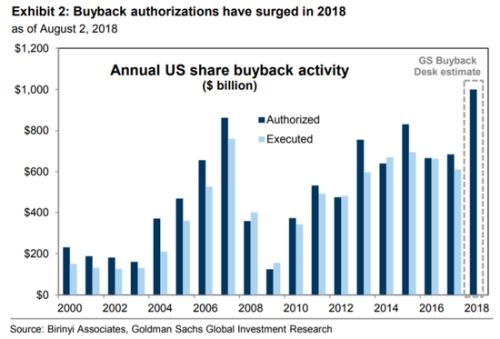

2. High Debt Levels:

Many companies are carrying high levels of debt, which can be risky if the market were to face a downturn. In fact, according to a report by the Federal Reserve, corporate debt in the US has reached a record high of $11.4 trillion.

3. Market Sentiment:

Investor sentiment has been increasingly bullish in recent years, which can lead to overexuberance and potential market corrections.

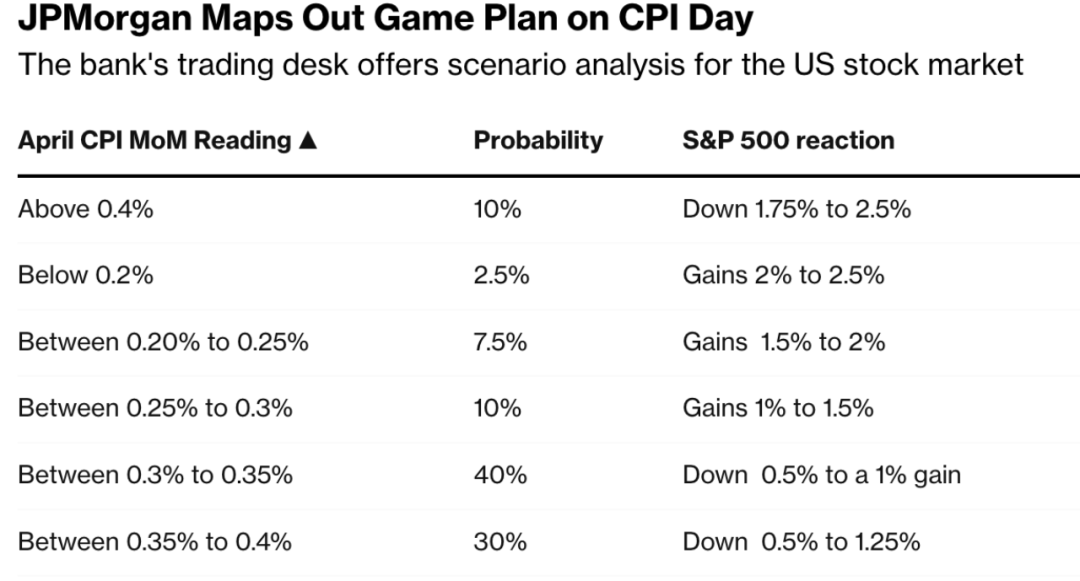

4. Inflation Concerns:

The current inflation rate in the US is hovering around 7%, which is the highest in 40 years. This has raised concerns about the potential impact on corporate earnings and the overall market.

Analysis:

While there are several indicators suggesting that the US stock market may be overpriced, it's essential to consider the broader economic context. Here are a few points to consider:

1. Economic Growth:

The US economy has been growing steadily over the past few years, with low unemployment rates and strong consumer spending. This has contributed to the rise in stock prices.

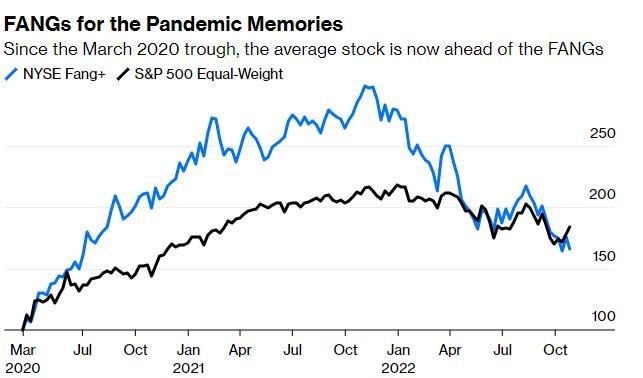

2. Technology Sector:

The technology sector has been a significant driver of the stock market's growth, with companies like Apple, Amazon, and Microsoft posting impressive earnings.

3. Diversification:

Investors with well-diversified portfolios may not be significantly affected by the current market conditions, as they can mitigate risks by investing in various asset classes.

Case Studies:

Several case studies illustrate the potential risks of an overvalued market. For instance, the dot-com bubble of the late 1990s saw many technology companies become overvalued, leading to a significant market correction in 2000.

Similarly, the 2008 financial crisis was caused, in part, by the overvaluation of real estate and mortgage-backed securities. These events highlight the importance of conducting thorough research and understanding the potential risks before investing.

Conclusion:

While the US stock market may currently be overpriced, it's essential to consider the broader economic context and the risks involved. Investors should conduct thorough research and consider diversifying their portfolios to mitigate potential risks. As always, it's crucial to consult with a financial advisor before making any investment decisions.

us stock market today