Invest in US Stocks from Malaysia: A Comprehensive Guide

author:US stockS -

Are you considering expanding your investment portfolio beyond the local market? Investing in US stocks from Malaysia can be a wise move, offering numerous benefits and opportunities. This guide will provide you with essential information and tips to help you get started.

Understanding the US Stock Market

The US stock market is one of the most advanced and liquid markets in the world. It offers a wide range of investment options, including stocks, bonds, ETFs, and more. The market is dominated by major exchanges like the New York Stock Exchange (NYSE) and the Nasdaq, which list some of the biggest and most successful companies globally.

Why Invest in US Stocks from Malaysia?

- Diversification: Investing in US stocks allows you to diversify your portfolio and reduce risk. The US market includes companies from various industries, offering exposure to different sectors and geographical regions.

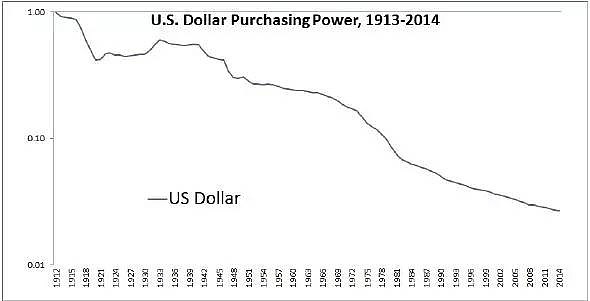

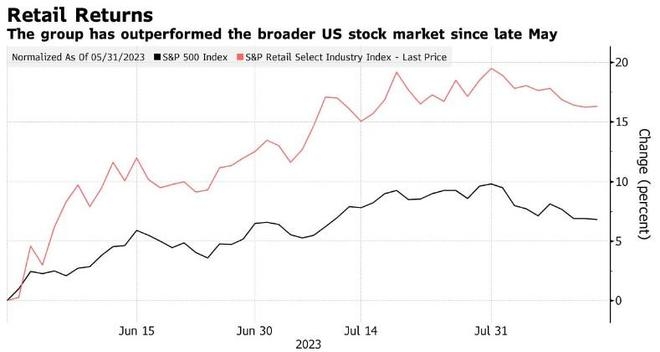

- Strong Market Performance: The US stock market has historically provided strong returns, making it an attractive option for investors seeking long-term growth.

- Access to World-Class Companies: The US market is home to some of the world's most innovative and successful companies, such as Apple, Microsoft, and Google.

- Currency Conversion: Investing in US stocks allows you to benefit from potential currency appreciation, as the US dollar is often stronger than the Malaysian ringgit.

How to Invest in US Stocks from Malaysia

- Open a Brokerage Account: To invest in US stocks, you need to open a brokerage account with a reputable online broker. Many brokers offer accounts specifically tailored for international investors.

- Research and Choose Stocks: Conduct thorough research to identify companies that align with your investment goals and risk tolerance. Consider factors like the company's financial health, growth prospects, and industry trends.

- Understand the Risks: Investing in foreign stocks involves additional risks, such as currency exchange rate fluctuations and political instability. Make sure you understand these risks and are comfortable with them before proceeding.

- Monitor Your Investments: Regularly review your investments and stay informed about market trends and company news. This will help you make informed decisions and adjust your portfolio as needed.

Tips for Successful Investing

- Start Small: If you're new to investing, consider starting with a small amount of capital and gradually increasing your investment as you gain more experience.

- Focus on Long-Term Growth: Avoid the temptation to chase short-term gains and focus on long-term growth potential.

- Stay Disciplined: Stick to your investment strategy and avoid making impulsive decisions based on emotions.

- Leverage Technology: Utilize online tools and resources to stay informed about market trends, company news, and investment opportunities.

Case Study: Investing in Apple Inc.

Apple Inc. (AAPL) is a prime example of a successful US stock investment. Since its initial public offering in 1980, Apple has grown into one of the world's most valuable companies. Investing in Apple stocks from Malaysia would have provided significant returns over the years, as the company's market capitalization has soared.

In conclusion, investing in US stocks from Malaysia can be a rewarding endeavor. By understanding the market, conducting thorough research, and managing risks, you can build a diversified and profitable investment portfolio.

us stock market today