Hartnett BOFA US Stock Market: A Comprehensive Analysis

author:US stockS -

In the ever-evolving landscape of the US stock market, understanding the insights provided by financial experts is crucial for investors seeking to make informed decisions. One such expert is Hartnett, a well-known figure at Bank of America (BOFA). This article delves into the perspectives shared by Hartnett on the US stock market, offering valuable insights for investors.

Understanding Hartnett’s Perspective

Hartnett’s Views on Market Trends Hartnett has consistently provided insightful views on market trends, particularly those impacting the US stock market. His analysis often revolves around key factors such as economic indicators, corporate earnings, and geopolitical events.

Impact of Economic Indicators One of Hartnett’s key areas of focus is the impact of economic indicators on the stock market. He emphasizes the importance of closely monitoring indicators like GDP growth, inflation rates, and unemployment rates. For instance, Hartnett recently highlighted that a strong GDP growth rate could indicate a robust economy, potentially leading to higher stock prices.

Corporate Earnings and Stock Valuations Hartnett also places significant emphasis on corporate earnings and their impact on stock valuations. He believes that companies with strong earnings growth have a better chance of outperforming the market. This perspective is evident in his recent analysis of the tech sector, where he highlighted companies with robust earnings growth as potential outperformers.

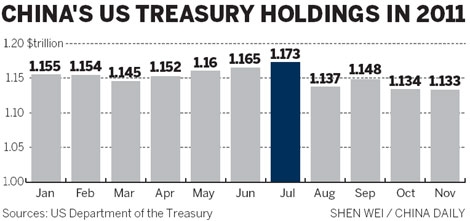

Geopolitical Events and Market Volatility Geopolitical events are another crucial factor in Hartnett’s analysis. He often warns investors about the potential impact of geopolitical tensions on the stock market. For example, the ongoing trade tensions between the US and China have been a key concern for Hartnett, as they could lead to increased market volatility.

Case Study: Tech Sector Analysis To illustrate Hartnett’s approach, let’s consider his recent analysis of the tech sector. Hartnett identified several tech companies with strong earnings growth and a solid business model as potential outperformers. One such company was Apple Inc. (AAPL), which has consistently delivered robust earnings growth and has a strong presence in the global market.

Hartnett’s Investment Strategy Hartnett’s investment strategy is centered around identifying companies with strong fundamentals and a favorable outlook. He advocates for a diversified portfolio that includes a mix of sectors and geographies. This strategy helps mitigate risks and maximize returns.

Conclusion In conclusion, Hartnett’s insights on the US stock market provide valuable guidance for investors. By focusing on economic indicators, corporate earnings, and geopolitical events, Hartnett offers a comprehensive analysis that can help investors make informed decisions. As the stock market continues to evolve, staying informed and seeking expert insights like those provided by Hartnett is essential for success.

us stock market today