HSBC Stock Quote US: Everything You Need to Know

author:US stockS -

In the fast-paced world of global finance, keeping up with stock quotes is crucial for investors. If you're looking to stay ahead of the curve, it's essential to understand the stock quote for HSBC, one of the world's largest banking and financial services organizations. This article delves into the latest HSBC stock quote in the US, providing you with the information you need to make informed investment decisions.

Understanding the HSBC Stock Quote

The HSBC stock quote in the US is represented by the ticker symbol HSBC. This ticker can be found on major financial websites and platforms, such as Yahoo Finance and Google Finance. When you see the HSBC stock quote, it typically includes the following information:

- Current Price: The current market price of HSBC stock.

- Day's High/Low: The highest and lowest prices the stock has reached during the trading day.

- 52-Week High/Low: The highest and lowest prices the stock has reached over the past 52 weeks.

- Market Capitalization: The total value of the company's outstanding shares.

- Dividend Yield: The annual dividend payment divided by the current stock price.

Factors Influencing the HSBC Stock Quote

Several factors can influence the HSBC stock quote in the US. These include:

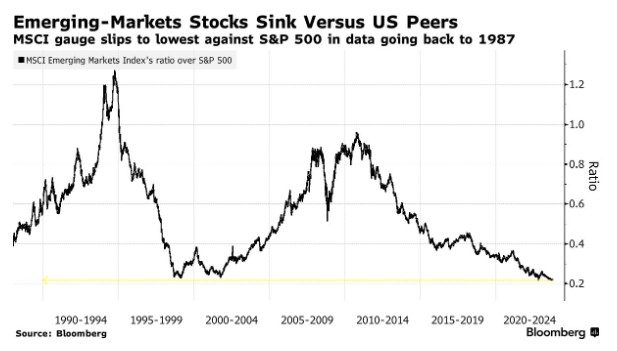

- Economic Indicators: Economic data, such as GDP growth, inflation, and employment rates, can impact the stock's performance.

- Global Events: Events such as political instability, trade disputes, and natural disasters can affect the stock.

- Company Performance: HSBC's financial results, including earnings reports and revenue growth, play a significant role in the stock's price.

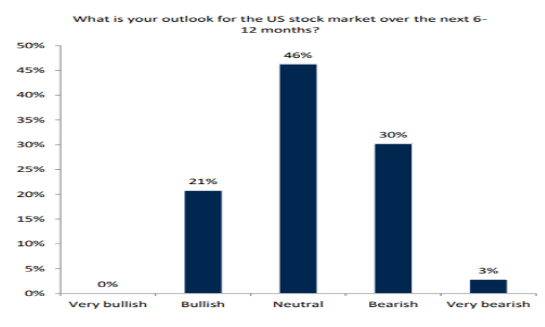

- Market Sentiment: The overall sentiment of the market can also influence the stock quote.

HSBC Stock Quote: Recent Performance

In recent years, the HSBC stock quote has experienced ups and downs. For instance, in 2020, the stock faced significant volatility due to the COVID-19 pandemic. However, the company managed to maintain a strong position in the global banking industry.

One notable example is the company's Q2 2020 results, where HSBC reported a net profit of $1.9 billion, a decrease of 35% from the same period in 2019. Despite the decrease, the company's performance was considered robust given the challenging economic environment.

Investing in HSBC Stock

When considering investing in HSBC stock, it's essential to conduct thorough research. This includes analyzing the stock's historical performance, the company's financial health, and the broader economic landscape.

As of the latest available data, HSBC's market capitalization stands at approximately $160 billion. The company offers a dividend yield of around 2.8%, which can be attractive for income-seeking investors.

However, it's crucial to keep in mind that investing in stocks always carries risks. It's advisable to consult with a financial advisor before making any investment decisions.

Conclusion

Staying informed about the HSBC stock quote in the US is essential for investors looking to capitalize on the global banking industry. By understanding the factors that influence the stock's performance and conducting thorough research, you can make informed investment decisions. Remember to consult with a financial advisor to ensure you're making the right choices for your investment portfolio.

us stock market today