FTSE 100 and US Stocks: A Comprehensive Comparison

author:US stockS -

In the world of global finance, the FTSE 100 and US stocks are two of the most influential indices. Both offer investors a glimpse into the economic health and market trends of their respective countries. This article delves into a comprehensive comparison of the FTSE 100 and US stocks, highlighting their unique characteristics and investment opportunities.

Understanding the FTSE 100

The FTSE 100, also known as the Financial Times Stock Exchange 100 Index, is a stock market index that tracks the performance of the 100 largest companies listed on the London Stock Exchange. These companies are selected based on their market capitalization, and the index is widely regarded as a benchmark for the UK's stock market.

Key Features of the FTSE 100:

- Geographical Focus: The FTSE 100 primarily represents the UK's economy, with a significant number of companies involved in sectors such as finance, retail, and energy.

- Market Capitalization: The index includes companies with a market capitalization of at least £1 billion.

- Sector Diversity: The FTSE 100 is well-diversified across various sectors, providing investors with exposure to a wide range of industries.

Understanding US Stocks

US stocks refer to the shares of companies listed on major US stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. The US stock market is the largest and most influential in the world, attracting investors from across the globe.

Key Features of US Stocks:

- Market Size: The US stock market is significantly larger than the UK market, with a vast array of companies across various sectors.

- Innovation and Technology: The US is home to numerous innovative companies, particularly in the technology sector, which dominate the US stock market.

- Diversification: Investors in US stocks have access to a wide range of companies, offering exposure to different industries and market trends.

Comparison of FTSE 100 and US Stocks

Market Size and Liquidity:

- FTSE 100: The FTSE 100 is a significant index, but it is relatively smaller compared to the US stock market. This can result in lower liquidity and potentially higher transaction costs.

- US Stocks: The US stock market is much larger and more liquid, making it easier for investors to trade shares and access capital.

Sector Focus:

- FTSE 100: The FTSE 100 is heavily focused on sectors such as finance, retail, and energy. This can limit the exposure to emerging sectors such as technology and healthcare.

- US Stocks: The US stock market offers a broader range of sectors, including technology, healthcare, and consumer goods, providing investors with more opportunities for diversification.

Investment Opportunities:

- FTSE 100: Investing in the FTSE 100 can provide exposure to the UK's economic growth and stability. However, it may be less appealing for investors seeking exposure to emerging markets or specific sectors.

- US Stocks: Investing in US stocks can offer access to a wide range of companies and sectors, providing investors with diverse investment opportunities.

Case Study:

Consider the comparison between two companies: BP (FTSE 100) and Apple (US Stocks).

- BP: BP is a UK-based oil and gas company with a significant presence in the FTSE 100. It provides exposure to the UK's energy sector but may be less appealing for investors seeking exposure to the rapidly growing technology sector.

- Apple: Apple is a US-based technology company listed on the NASDAQ. It offers exposure to the technology sector and is widely regarded as a leading innovator in the industry.

In conclusion, both the FTSE 100 and US stocks offer unique investment opportunities. Investors should consider their investment goals, risk tolerance, and market exposure when deciding between the two.

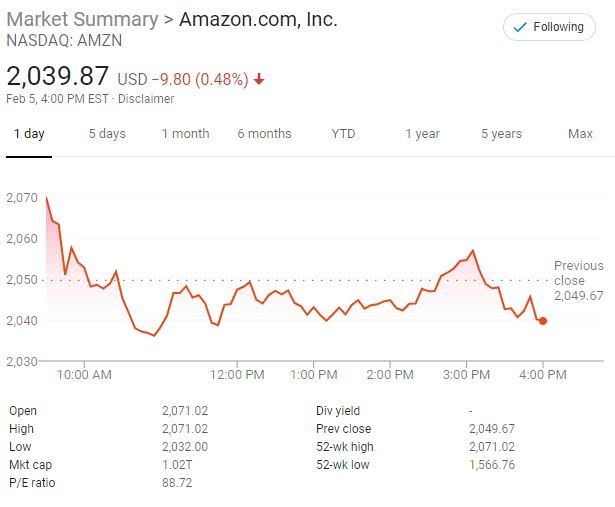

us stock market today