Easter Monday: A Look at the US Stock Market

author:US stockS -

Easter Monday, the day following Easter Sunday, is a significant day for many Christians around the world. However, for investors and traders, it's also a day that can have a significant impact on the US stock market. In this article, we'll delve into how Easter Monday can affect the stock market and what investors should keep an eye on.

Understanding the Impact

Easter Monday is often a holiday in many countries, including the United States. This means that trading volumes can be lower than usual. When trading volumes are lower, the stock market can be more volatile, as there are fewer participants to drive prices.

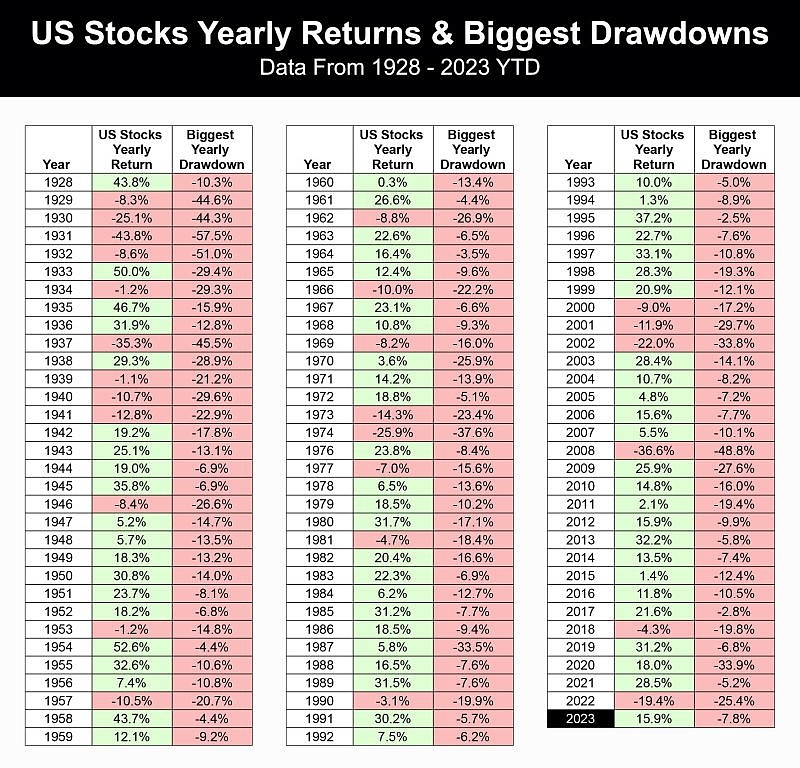

Historical Data

Historical data shows that the stock market tends to perform well on Easter Monday. According to a study by The Wall Street Journal, the S&P 500 has gained an average of 0.5% on Easter Monday over the past 20 years. This suggests that the holiday may not have a significant negative impact on the market.

Market Trends

One of the key factors that can affect the stock market on Easter Monday is market trends. For example, if the market has been on an uptrend leading up to the holiday, it's likely to continue its upward momentum on Easter Monday. Conversely, if the market has been on a downtrend, it may continue to fall on Easter Monday.

Sector Performance

Different sectors of the stock market can also be affected differently by Easter Monday. For instance, consumer discretionary stocks may see increased trading volumes as consumers spend more during the holiday period. On the other hand, defensive sectors like healthcare and utilities may see less volatility.

Case Studies

Let's take a look at a few case studies to understand the impact of Easter Monday on the stock market better.

- 2019: In 2019, the S&P 500 gained 0.6% on Easter Monday, following a strong rally in the weeks leading up to the holiday.

- 2020: The stock market was volatile in 2020 due to the COVID-19 pandemic. However, the S&P 500 still managed to gain 0.3% on Easter Monday.

- 2021: In 2021, the S&P 500 gained 0.7% on Easter Monday, following a strong rally in the weeks leading up to the holiday.

What Investors Should Know

As an investor, it's important to keep the following in mind when considering the stock market on Easter Monday:

- Volatility: Lower trading volumes can lead to increased volatility, so it's important to be cautious when making investment decisions.

- Market Trends: Pay attention to market trends leading up to the holiday, as they can provide insight into how the market may perform on Easter Monday.

- Sector Performance: Different sectors can be affected differently, so it's important to diversify your portfolio.

In conclusion, while Easter Monday can have an impact on the US stock market, historical data suggests that it's not a day that should be feared by investors. By understanding market trends and sector performance, investors can make informed decisions and navigate the market effectively on this holiday.

us stock market today