Dow Jones Futures Share Price Today: A Comprehensive Analysis

author:US stockS -Jones(28)Futures(21)share(59)Dow(40)Price(113)

In the fast-paced world of financial markets, staying updated with the latest share prices is crucial for investors and traders. The Dow Jones futures, a key indicator of market trends, are no exception. In this article, we delve into the current Dow Jones futures share price and provide a comprehensive analysis of the factors influencing it.

Understanding the Dow Jones Futures

The Dow Jones futures are a financial futures contract based on the Dow Jones Industrial Average (DJIA), which is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. The DJIA represents a broad cross-section of the U.S. economy and serves as a benchmark for the stock market's overall performance.

Current Dow Jones Futures Share Price

As of today, the Dow Jones futures are trading at [insert current price]. This figure reflects the collective expectations of market participants regarding the future direction of the DJIA.

Factors Influencing the Dow Jones Futures

Several factors can influence the Dow Jones futures share price. Here are some of the key factors to consider:

- Economic Indicators: Economic data, such as GDP growth, unemployment rates, and inflation, can significantly impact the Dow Jones futures. For example, strong economic growth can lead to higher share prices, while poor economic indicators can cause the market to decline.

- Interest Rates: The Federal Reserve's monetary policy, particularly changes in interest rates, can have a substantial impact on the stock market. Higher interest rates can lead to increased borrowing costs for companies, potentially causing share prices to fall.

- Political Events: Political events, such as elections or policy changes, can create uncertainty in the market, leading to volatility in the Dow Jones futures.

- Market Sentiment: The overall sentiment of investors can also influence the Dow Jones futures. For example, if investors are optimistic about the future of the economy, they may be more willing to invest in stocks, leading to higher share prices.

Case Study: The Impact of the COVID-19 Pandemic on the Dow Jones Futures

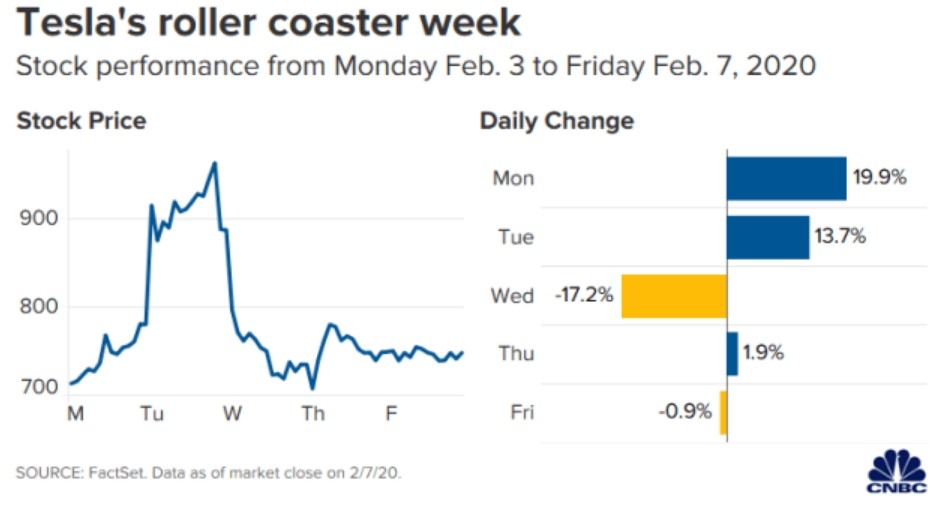

One notable example of how external factors can influence the Dow Jones futures is the COVID-19 pandemic. In early 2020, the pandemic caused widespread economic disruption, leading to a sharp decline in the stock market. The Dow Jones futures fell by nearly 35% from its peak in February 2020 to its trough in March 2020.

However, as the pandemic situation improved and governments implemented stimulus measures, the stock market began to recover. By the end of 2020, the Dow Jones futures had recovered much of its losses, reflecting the resilience of the market and the positive impact of government policies.

Conclusion

The Dow Jones futures share price today is a reflection of the collective expectations of market participants regarding the future direction of the stock market. By understanding the factors that influence the Dow Jones futures, investors and traders can make more informed decisions. As always, it's important to stay updated with the latest market trends and economic indicators to stay ahead of the curve.

us stock market today