Canadians Investing in US Stocks: A Comprehensive Guide

author:US stockS -

Introduction

The United States has long been a favored destination for international investors, and Canada is no exception. With a strong economic relationship between the two nations, many Canadian investors have turned their eyes toward the US stock market. But what do you need to know before making that investment? This comprehensive guide will explore the factors to consider when investing in US stocks from a Canadian perspective.

Understanding the Market

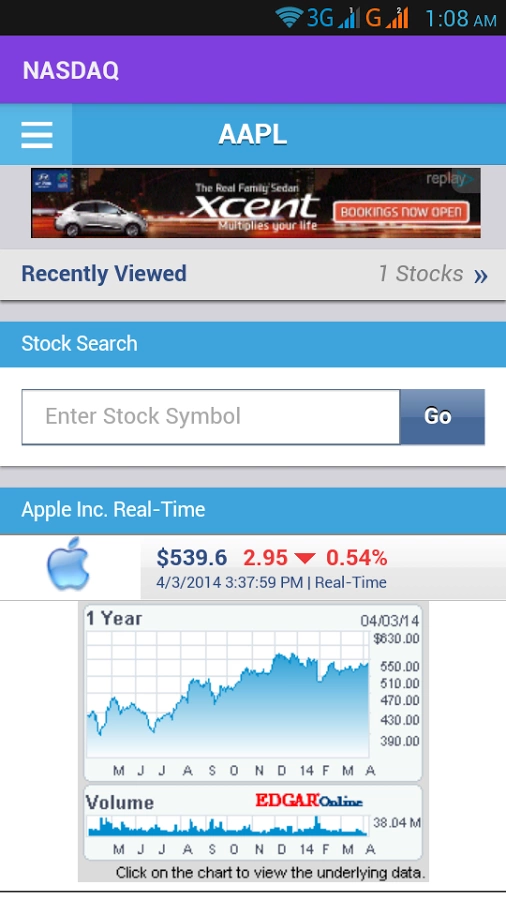

The US stock market is one of the largest and most diversified in the world. It includes a variety of sectors and asset classes, such as technology, healthcare, finance, and more. This diversity provides Canadian investors with numerous opportunities to invest in companies that align with their investment goals and risk tolerance.

Key Factors to Consider

Currency Exchange Rates: One of the primary concerns for Canadian investors is the impact of currency exchange rates. Investing in US stocks means dealing with a different currency, which can fluctuate. Understanding the potential for currency gains or losses is crucial.

Tax Implications: Tax laws vary between Canada and the United States. It's essential to consult with a financial advisor or tax professional to understand the tax implications of investing in US stocks, including capital gains tax and dividend tax.

Regulations: The US and Canada have different regulatory environments. Canadian investors need to be aware of the rules and regulations that govern the US stock market and the companies they're investing in.

Best Practices for Canadian Investors

Diversify Your Portfolio: Investing in a variety of US stocks can help reduce risk. Diversification is a key strategy for all investors, regardless of where they're based.

Stay Informed: Keep up with market trends, company news, and economic indicators. Being informed can help you make more informed investment decisions.

Use a Brokerage: Many Canadian investors use a brokerage firm that specializes in US stock trading. These firms can provide valuable resources and support to help you navigate the US market.

Consider Long-Term Investing: Historically, long-term investing has been beneficial for US stock market investors. Canadian investors should consider this approach as well.

Case Studies

To illustrate the potential benefits of investing in US stocks, let's consider two Canadian investors with different approaches:

Investor A is a young investor looking for growth. After thorough research, they decide to invest in a US-based tech company known for its innovation. Over the years, the company grows exponentially, and their investment pays off handsomely.

Investor B, on the other hand, is more conservative. They opt to invest in a diverse mix of US stocks, including healthcare, consumer goods, and utilities. While their returns may not be as high as Investor A, their investment is more stable and provides consistent growth.

Conclusion

Investing in US stocks from Canada can be a rewarding endeavor for those who do their research and understand the associated risks. By following these tips and remaining informed, Canadian investors can capitalize on the opportunities the US stock market has to offer.

us stock market today