Can I Buy US Stocks in a Canadian TFSA?

author:US stockS -

Are you a Canadian investor looking to expand your portfolio with U.S. stocks? If so, you might be wondering if you can purchase U.S. stocks within your Tax-Free Savings Account (TFSA). The good news is that you can, but there are some important considerations to keep in mind. In this article, we'll explore the ins and outs of buying U.S. stocks in a Canadian TFSA.

Understanding the TFSA

First, let's clarify what a TFSA is. A TFSA is a registered account in Canada that allows you to invest tax-free. Contributions are not tax-deductible, but any investment growth, dividends, or interest earned within the account is tax-free. This makes it an attractive option for long-term investing and saving.

Buying U.S. Stocks in a TFSA

Yes, you can buy U.S. stocks in a Canadian TFSA. However, there are a few key points to consider:

Currency Conversion: When purchasing U.S. stocks, you'll need to convert Canadian dollars to U.S. dollars. This conversion can be done through your brokerage firm or financial institution. Keep in mind that currency conversion fees may apply.

Brokerage Fees: When buying U.S. stocks, you'll need to pay brokerage fees. These fees can vary depending on your brokerage firm, so it's important to compare and choose a firm that offers competitive rates.

U.S. Tax Implications: While the income earned within your TFSA is tax-free, there are some U.S. tax implications to consider. If you hold U.S. stocks for less than a year, any dividends or interest earned may be subject to U.S. withholding tax. However, if you hold the stocks for more than a year, the U.S. withholding tax may be reduced or eliminated.

Dollar Denomination: U.S. stocks are typically priced in U.S. dollars. This means that the value of your investment will fluctuate based on the exchange rate between the Canadian dollar and the U.S. dollar.

Advantages of Buying U.S. Stocks in a TFSA

Despite the considerations mentioned above, there are several advantages to buying U.S. stocks in a Canadian TFSA:

- Diversification: Investing in U.S. stocks can help diversify your portfolio and reduce risk.

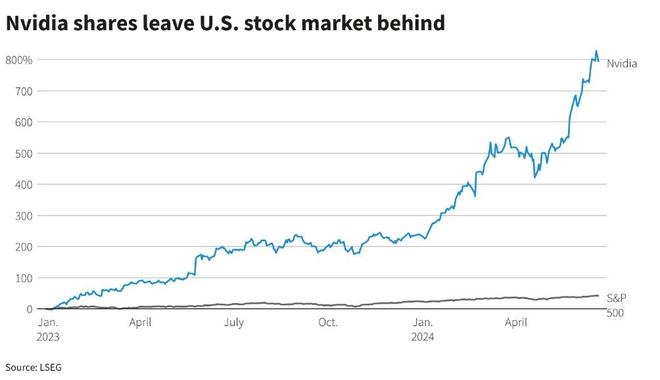

- Potential for Higher Returns: The U.S. stock market has historically offered higher returns than the Canadian market.

- Tax-Free Growth: Any income earned within your TFSA is tax-free, allowing you to maximize your returns.

Case Study: Investing in U.S. Stocks in a TFSA

Let's consider a hypothetical example. Suppose you have a

Conclusion

In conclusion, you can buy U.S. stocks in a Canadian TFSA. While there are some considerations to keep in mind, the potential benefits of diversification and tax-free growth make it an attractive option for Canadian investors. Be sure to research and choose a reputable brokerage firm, and consult with a financial advisor if needed.

us stock market today