Can Chinese National Invest in the US Stock Market?

author:US stockS -

Are you a Chinese national looking to expand your investment portfolio? Have you ever wondered if you can invest in the US stock market? The answer is a resounding yes! The US stock market is one of the most dynamic and profitable markets in the world, offering numerous opportunities for investors from all over the globe. In this article, we will explore the process of investing in the US stock market for Chinese nationals, including the requirements, risks, and potential benefits.

Understanding the Basics

Before diving into the details, it's essential to understand the basics of the US stock market. The stock market is a platform where companies can raise capital by selling shares of their ownership to investors. These shares are then bought and sold on stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ.

Eligibility and Requirements

To invest in the US stock market as a Chinese national, you need to meet certain requirements:

- Valid Passport: You must have a valid Chinese passport.

- Residency Status: You need to be a resident of the United States or have a valid visa.

- Bank Account: You will need a US-based bank account to facilitate transactions.

- Tax Identification Number (TIN): As a non-US resident, you will need an ITIN (Individual Taxpayer Identification Number) or an EIN (Employer Identification Number) to file taxes.

Opening a Brokerage Account

The next step is to open a brokerage account. A brokerage account is a type of account that allows you to buy and sell stocks, bonds, and other securities. There are several reputable brokerage firms that cater to international investors, such as Charles Schwab, Fidelity, and TD Ameritrade.

Choosing Stocks

Once you have your brokerage account, you can start researching and selecting stocks to invest in. It's crucial to conduct thorough research and consider factors such as the company's financial health, industry trends, and market conditions.

Risks and Considerations

While investing in the US stock market can be lucrative, it's essential to be aware of the risks involved:

- Currency Fluctuations: The value of the US dollar can fluctuate against the Chinese yuan, impacting your investment returns.

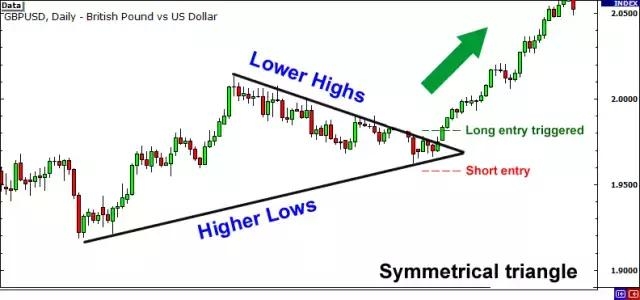

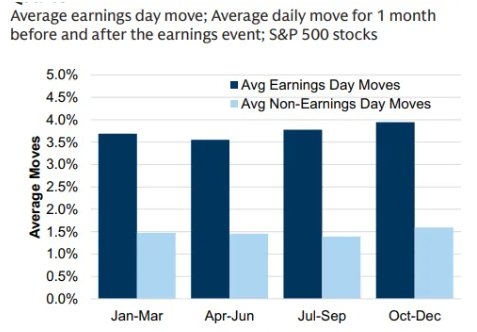

- Market Volatility: The stock market can be unpredictable, and your investments may experience significant ups and downs.

- Tax Implications: As a non-US resident, you will need to pay taxes on your investment gains, which can be a complex process.

Case Studies

Let's take a look at a few case studies to understand the potential benefits of investing in the US stock market:

- Apple Inc.: A Chinese national invested

10,000 in Apple Inc. stock in 2010. As of 2021, their investment is worth over 100,000, demonstrating the potential for significant growth. - Tesla Inc.: Another Chinese national invested

5,000 in Tesla Inc. stock in 2013. By 2021, their investment had grown to over 50,000, showcasing the rapid growth of innovative companies.

Conclusion

Investing in the US stock market as a Chinese national is not only possible but also offers numerous opportunities for growth and diversification. By understanding the requirements, conducting thorough research, and being aware of the risks, you can make informed investment decisions and potentially achieve significant returns.

us stock market today