Best Energy Stocks in the US: A Comprehensive Guide

author:US stockS -

In today's rapidly evolving energy landscape, investing in the right stocks can be a game-changer for your portfolio. The United States, being a leading energy producer, offers a plethora of opportunities for investors looking to capitalize on the energy sector. This guide will highlight some of the best energy stocks in the US, providing insights into their potential and strategies for investment.

1. Exxon Mobil Corporation (XOM)

Exxon Mobil Corporation, often referred to as Exxon, is one of the largest publicly traded oil and gas companies in the world. The company has a diversified portfolio, including exploration, production, refining, and marketing. With a strong track record of profitability and stability, Exxon Mobil is a solid choice for long-term investors.

2. Chevron Corporation (CVX)

Chevron Corporation is another major player in the energy sector, offering a wide range of products and services, including oil and gas exploration, production, and refining. With a focus on sustainable operations and innovation, Chevron has been able to maintain its position as a leader in the industry.

3. Royal Dutch Shell PLC (RDS.A/RDS.B)

Royal Dutch Shell is a global energy company with a significant presence in the US. The company operates in various segments, including upstream (exploration and production), downstream (refining and marketing), and integrated gas. Shell's commitment to renewable energy and its diverse portfolio make it an attractive investment option.

4. BP PLC (BP)

BP, formerly known as British Petroleum, is an international oil and gas company with operations in more than 70 countries. The company has a strong focus on safety, sustainability, and innovation. BP's extensive portfolio, including exploration, production, and refining, makes it a compelling investment choice.

5. Schlumberger Limited (SLB)

Schlumberger is a leading provider of technology, information, and services to the oil and gas industry. The company offers a wide range of services, from exploration and production to well construction and maintenance. Schlumberger's commitment to innovation and its global presence make it a solid investment option.

6. EOG Resources, Inc. (EOG)

EOG Resources is an independent oil and gas exploration and production company focused on the onshore US. The company has a strong track record of growth and profitability, with a focus on unconventional resources. EOG's commitment to efficiency and innovation makes it an attractive investment for those looking to capitalize on the US energy sector.

7. Occidental Petroleum Corporation (OXY)

Occidental Petroleum Corporation is an oil and gas exploration and production company with operations in the US and internationally. The company has a diverse portfolio, including conventional and unconventional resources. Occidental's focus on operational excellence and its commitment to sustainability make it a compelling investment option.

8. ConocoPhillips (COP)

ConocoPhillips is an independent oil and gas exploration and production company with operations in the US and internationally. The company has a strong track record of profitability and stability, with a focus on efficient operations and responsible resource management.

9. Marathon Oil Corporation (MRO)

Marathon Oil Corporation is an independent oil and gas exploration and production company with operations in the US and internationally. The company has a diverse portfolio, including conventional and unconventional resources. Marathon's focus on innovation and its commitment to sustainability make it an attractive investment option.

10. Hess Corporation (HES)

Hess Corporation is an independent oil and gas exploration and production company with operations in the US and internationally. The company has a strong track record of profitability and stability, with a focus on efficient operations and responsible resource management.

When investing in energy stocks, it's crucial to consider various factors, such as the company's financial health, management team, market conditions, and future growth prospects. By conducting thorough research and staying informed about the industry, investors can make informed decisions and potentially achieve significant returns.

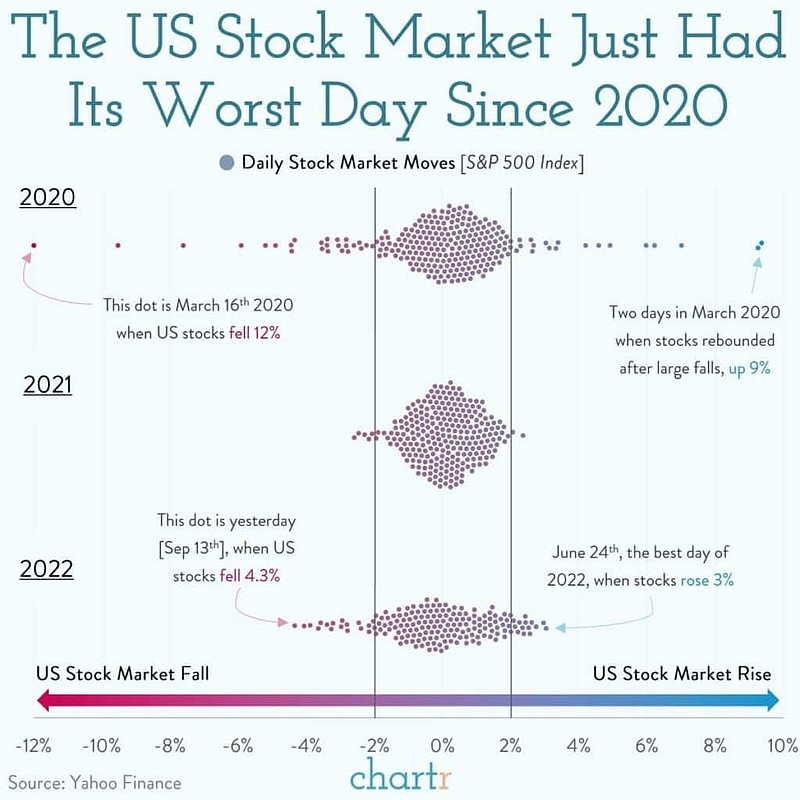

us stock market today