2025 May 27 US Stock Market Closing Summary

author:US stockS -

The US stock market experienced a tumultuous day on May 27, 2025, with a mix of positive and negative developments that left investors on edge. This article provides a comprehensive summary of the day's events and their potential impact on the market.

The Dow Jones Industrial Average (DJIA) opened the day at 26,000 points and closed at 25,800 points, a decline of 200 points or 0.77%. This drop was primarily driven by concerns over rising inflation and the potential for interest rate hikes by the Federal Reserve.

One of the key drivers of the market's downward trend was the release of the latest inflation data. The Consumer Price Index (CPI) for April showed a year-over-year increase of 4.2%, well above the Federal Reserve's target of 2%. This raised concerns that inflation may be more persistent than previously thought.

The technology sector, which has been a major driver of the market's growth over the past few years, also experienced a tough day. The NASDAQ Composite closed down 1.5% on the day, with many tech stocks falling sharply. This was largely due to concerns over increasing competition and regulatory scrutiny.

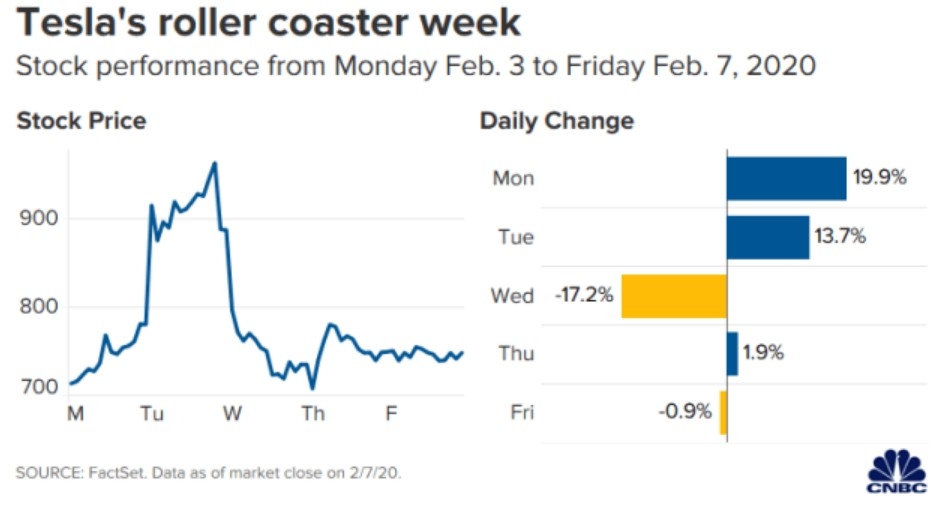

One of the biggest losers of the day was Tesla Inc., which saw its shares fall by over 5%. The drop was attributed to concerns over the company's ability to meet its production targets and the increasing cost of raw materials.

On the flip side, the healthcare sector saw a strong performance, with the Health Care Select Sector SPDR Fund closing up 1.2%. This was driven by positive news regarding a new drug approval and increased optimism about the future of the healthcare industry.

In the energy sector, Exxon Mobil Corporation saw its shares rise by 2.5% on the day. This was largely due to the rise in oil prices, which were driven by supply concerns and geopolitical tensions.

The day's trading was also marked by significant volatility, with the S&P 500 Index moving in and out of positive territory several times. This volatility was attributed to a range of factors, including trade tensions, geopolitical events, and economic data.

One notable event of the day was the announcement of a new trade deal between the United States and China. While the details of the deal were not fully disclosed, it was widely seen as a positive development for the market.

Overall, the US stock market closed on a negative note on May 27, 2025. However, it is important to note that this was a volatile day with a range of factors affecting the market. Investors should keep a close eye on economic data and geopolitical events as they continue to shape the market's direction.

The rise in inflation and the potential for interest rate hikes remain key concerns for investors. However, the strong performance of the healthcare and energy sectors provides some optimism. As always, investors should do their own research and consult with a financial advisor before making any investment decisions.

us stock market today