Unlocking US Growth Stocks with the Right ETF

author:US stockS -

In the ever-evolving world of investments, growth stocks have always been a beacon for investors seeking substantial returns. The United States, with its robust economy and numerous emerging companies, is a prime destination for growth-oriented investors. One of the most efficient ways to tap into this market is through an ETF (Exchange-Traded Fund) specifically designed for US growth stocks. This article delves into the intricacies of these funds, their benefits, and how they can be a game-changer for your investment portfolio.

Understanding US Growth Stocks ETFs

A US growth stocks ETF is a basket of stocks that are selected based on their potential for rapid growth. These companies often operate in high-growth industries and have strong financial performance. By investing in a growth stocks ETF, investors gain exposure to a diverse portfolio of these high-potential stocks, mitigating the risk associated with individual stock investments.

Key Features of US Growth Stocks ETFs

Diversification: One of the primary advantages of investing in a growth stocks ETF is diversification. By investing in a basket of stocks, investors can reduce the risk associated with any single stock's performance.

Low Cost: ETFs are known for their low management fees compared to mutual funds. This makes them an attractive option for investors looking to maximize their returns.

Liquidity: ETFs are traded on exchanges like stocks, making them highly liquid. Investors can buy and sell shares throughout the trading day at market prices.

Ease of Access: Investing in a growth stocks ETF is straightforward. Investors can purchase shares through a brokerage account, just like they would with individual stocks.

Top US Growth Stocks ETFs to Consider

Vanguard Growth ETF (VUG): This ETF tracks the Russell 1000 Growth Index and includes companies like Apple, Microsoft, and Visa. It is known for its low fees and diversification.

iShares Expanded Tech-Software Sector ETF (IGV): This ETF focuses on the technology sector, which is often a hotbed for growth stocks. It includes companies like Adobe, Salesforce, and Microsoft.

ARK Innovation ETF (ARKK): This ETF focuses on disruptive innovation in sectors like artificial intelligence, robotics, and blockchain. It includes companies like Tesla, NVIDIA, and Zoom.

Benefits of Investing in US Growth Stocks ETFs

Access to High-Potential Stocks: Investors can gain exposure to companies with strong growth potential without having to conduct extensive research.

Professional Management: ETFs are managed by professionals who have the expertise to select the best stocks for inclusion in the fund.

Tax Efficiency: ETFs are taxed like stocks, which can be more tax-efficient than traditional mutual funds.

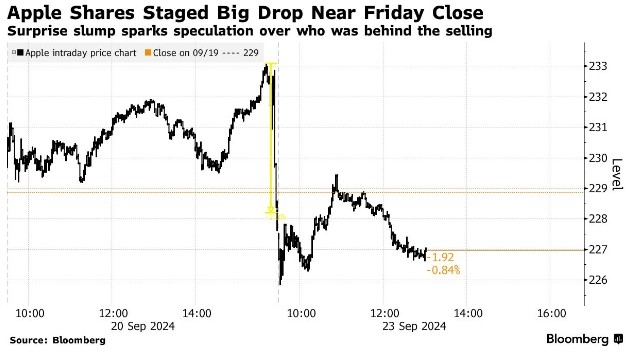

Case Study: Apple Inc.

Consider Apple Inc., a company that has been a part of several growth stocks ETFs. Since its inclusion in these funds, Apple has consistently delivered strong returns, making it a valuable addition to any growth-oriented portfolio.

Conclusion

Investing in US growth stocks ETFs can be a powerful way to grow your investment portfolio. With the right ETF, investors can gain access to a diverse portfolio of high-potential stocks, all while enjoying the benefits of low costs, liquidity, and professional management. By understanding the intricacies of these funds, investors can make informed decisions and potentially reap the rewards of investing in growth stocks.

us stock market live