US Oil Drilling Companies Stock: A Comprehensive Guide

author:US stockS -

In the ever-evolving world of energy, the stock market performance of oil drilling companies has always been a topic of interest for investors. With the rise of renewable energy sources, some might question the stability and growth potential of these companies. However, a closer look at the US oil drilling industry reveals a different picture. This article will delve into the key aspects of US oil drilling companies stock, including market trends, factors affecting stock prices, and potential investment opportunities.

Understanding the Market Trends

The US oil drilling industry has seen significant changes over the years. One of the major trends is the shift towards horizontal drilling and hydraulic fracturing, also known as "fracking." This technology has allowed companies to extract oil and gas from previously inaccessible reserves, leading to a surge in production. As a result, the stock prices of many US oil drilling companies have seen substantial growth.

Factors Affecting Stock Prices

Several factors can influence the stock prices of US oil drilling companies. Here are some of the key factors to consider:

Oil and Gas Prices: The prices of crude oil and natural gas are the most significant factors affecting the profitability of oil drilling companies. Higher prices generally lead to increased revenue and higher stock prices.

Production Volume: The amount of oil and gas produced by a company can also impact its stock price. Higher production volumes often translate to higher revenue and profitability.

Technological Advancements: Continuous technological improvements in drilling and extraction methods can enhance a company's efficiency and productivity, leading to higher stock prices.

Regulatory Environment: Changes in government policies and regulations can have a significant impact on the operations of oil drilling companies. For instance, stricter environmental regulations may increase costs and reduce profitability.

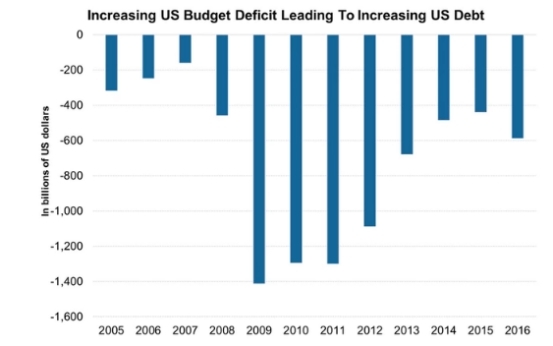

Economic Factors: The overall state of the global economy, including factors like inflation and currency fluctuations, can also influence stock prices.

Investment Opportunities

Despite the challenges faced by the oil drilling industry, there are still opportunities for investors. Here are some potential investment strategies:

Diversification: Investing in a mix of oil drilling companies can help mitigate risks associated with market volatility.

Focus on High-Performing Companies: Look for companies with strong financial performance, efficient operations, and a commitment to innovation.

Consider Dividend Stocks: Some oil drilling companies offer dividends, providing investors with a regular income stream.

Long-Term Investment: The oil and gas industry can be cyclical, so a long-term investment horizon may be beneficial.

Case Studies

To illustrate the potential of US oil drilling companies, let's consider two case studies:

Eclipse Resources Corporation: This company has seen significant growth in its stock price due to its successful horizontal drilling and fracking operations in the Utica Shale Formation. Its commitment to innovation and efficient operations has contributed to its success.

Halliburton Company: As one of the world's largest oilfield services companies, Halliburton has a diverse portfolio of services that support the oil drilling industry. Its strong financial performance and global presence make it an attractive investment option.

In conclusion, US oil drilling companies stock offers a mix of risks and opportunities. By understanding the market trends, factors affecting stock prices, and potential investment strategies, investors can make informed decisions. While the industry faces challenges, the right approach can lead to significant returns.

us stock market live