US GDP Signals Problem in the Stock Market

author:US stockS -

The stock market is a reflection of the broader economic landscape, and the United States Gross Domestic Product (GDP) is a critical indicator of economic health. When the GDP signals a problem, it's a red flag for investors and analysts alike. This article delves into how the US GDP impacts the stock market and highlights key concerns that investors should be aware of.

Understanding GDP and Its Significance

Gross Domestic Product (GDP) is the total value of all goods and services produced within a country over a specific period. It is a comprehensive measure of economic activity and is used to gauge the overall health of an economy. A rising GDP suggests economic growth, while a falling GDP indicates economic contraction.

How GDP Impacts the Stock Market

The stock market is influenced by various economic indicators, and the GDP is one of the most influential ones. Here’s how:

Economic Growth Expectations: A growing GDP indicates higher corporate earnings, which typically translates to higher stock prices. Conversely, a contracting GDP suggests lower earnings and may lead to stock price declines.

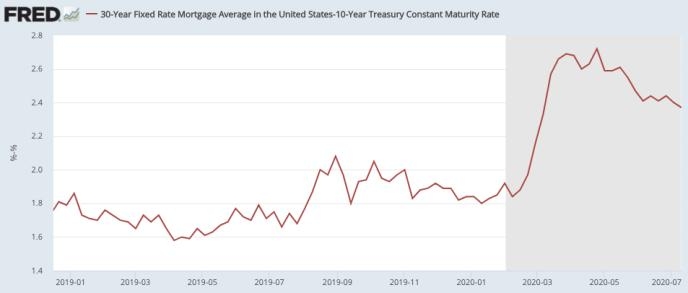

Interest Rates: The Federal Reserve, which sets interest rates, closely monitors the GDP. A strong GDP may lead to higher interest rates to control inflation, which can negatively impact stocks.

Investor Sentiment: A strong GDP often boosts investor confidence, leading to increased stock market participation. On the other hand, a weak GDP can lead to uncertainty and risk aversion, causing investors to pull back from the stock market.

Recent Concerns and Case Studies

Recent economic data has raised concerns about the US GDP and its potential impact on the stock market. Here are some key points and case studies:

Slowing Economic Growth: The US GDP growth rate has slowed in recent quarters, raising concerns about a potential economic slowdown. For instance, in Q2 2021, the US GDP grew at an annual rate of 6.7%, but this slowed to 2.3% in Q4 2021.

Inflation: Rising inflation is a significant concern for the US economy and the stock market. The Consumer Price Index (CPI) has been above the Federal Reserve's target of 2% for several months, indicating higher prices for consumers and businesses.

Tech Stocks: Tech stocks have been a significant component of the stock market's growth in recent years. However, concerns about slowing economic growth and rising inflation have led to a decline in tech stock valuations.

Conclusion

The US GDP is a critical indicator of economic health and a significant driver of the stock market. When the GDP signals a problem, it's essential for investors to pay attention and adjust their strategies accordingly. By understanding the impact of GDP on the stock market and monitoring key economic indicators, investors can better navigate the market's complexities and make informed decisions.

us stock market live