Title: Understanding US Companies Stock: A Comprehensive Guide

author:US stockS -

Introduction: In the dynamic world of finance, understanding how to invest in US companies stock is a crucial skill. Whether you are a seasoned investor or a beginner, having a grasp on the basics of US stock market investing can lead to substantial financial gains. In this article, we will explore the key aspects of US companies stock, including market trends, investment strategies, and potential risks.

Understanding the Stock Market The stock market is a marketplace where shares of publicly-traded companies are bought and sold. When you invest in a company's stock, you are essentially purchasing a small piece of that company. The value of a stock is determined by supply and demand, and its price can fluctuate significantly based on market conditions and company performance.

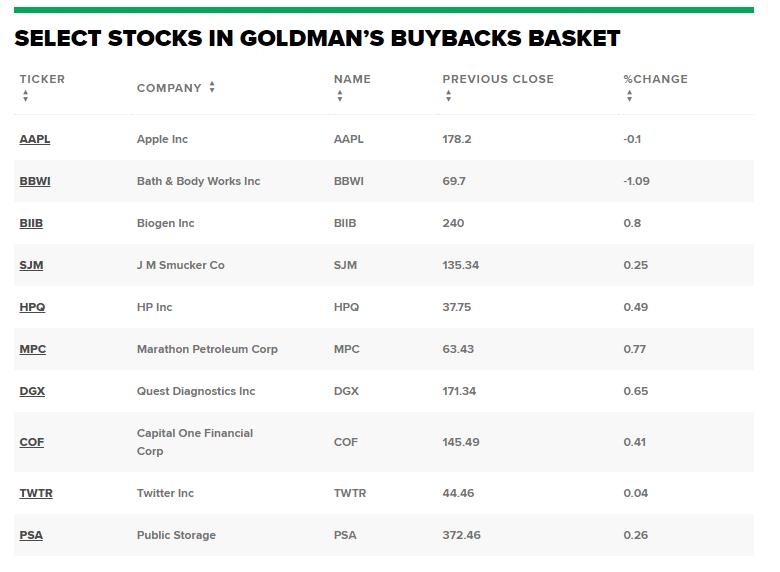

Key Market Trends Several key trends have shaped the US stock market in recent years. One major trend is the rise of technology stocks, which have been driving much of the market's growth. Companies like Apple, Amazon, and Microsoft have seen their shares soar, attracting investors from around the world.

Investment Strategies When it comes to investing in US companies stock, there are several strategies you can consider:

- Dividend Stocks: Dividend stocks are shares of companies that pay out a portion of their earnings to shareholders. These stocks can provide a steady income stream and are often considered less risky than growth stocks.

- Growth Stocks: Growth stocks are shares of companies that are expected to grow at an above-average rate. These stocks are often riskier than dividend stocks but can offer higher returns.

- Value Stocks: Value stocks are shares of companies that are trading at a lower price relative to their fundamentals. These stocks can be a good long-term investment if you believe the market has undervalued them.

Analyzing Company Performance Before investing in a company's stock, it's essential to analyze its performance. Key metrics to consider include revenue growth, earnings per share (EPS), price-to-earnings (P/E) ratio, and debt-to-equity ratio.

Case Study: Apple Inc. A prime example of a successful investment in US companies stock is Apple Inc. Since its initial public offering (IPO) in 1980, Apple has seen its stock price skyrocket. This growth can be attributed to its innovative products, strong brand, and effective marketing strategies.

Risks to Consider While investing in US companies stock can be profitable, it's important to be aware of the risks involved. These include market volatility, economic downturns, and company-specific issues such as poor management or product failures.

Conclusion Understanding how to invest in US companies stock is a valuable skill for anyone interested in the stock market. By staying informed, analyzing company performance, and adopting a well-thought-out investment strategy, you can increase your chances of success. Remember, investing in the stock market always involves risk, so it's crucial to do your homework and consult with a financial advisor if needed.

us stock market live