Title: Overall US Stock Market: A Comprehensive Overview

author:US stockS -

Introduction

The US stock market, often referred to as the overall US stock market, is a cornerstone of the global financial landscape. As the world's largest stock market, it plays a crucial role in the economic and financial health of the United States. In this article, we'll take a deep dive into the key aspects of the overall US stock market, including its structure, performance, and future outlook.

Market Structure

The US stock market is divided into several segments, each serving a different purpose. The primary segments include:

- The New York Stock Exchange (NYSE): As the oldest and most prominent stock exchange in the United States, the NYSE is home to some of the world's largest and most well-known companies.

- The NASDAQ Stock Market: Known for its high-tech focus, the NASDAQ hosts many technology companies, including giants like Apple, Microsoft, and Amazon.

- The Over-the-Counter (OTC) Markets: These markets are for smaller companies that may not meet the listing requirements of the NYSE or NASDAQ.

Performance

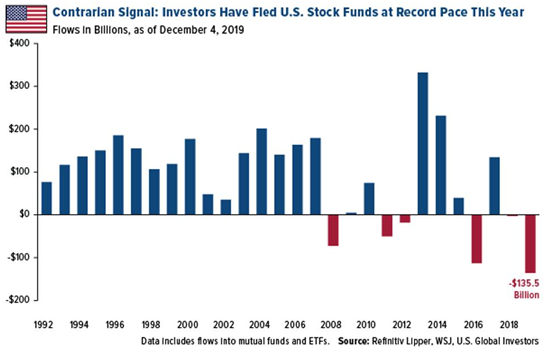

The overall US stock market has seen significant growth over the years. According to data from the Federal Reserve, the total value of stocks listed on the major exchanges has more than doubled since the early 2000s. This growth has been driven by a combination of factors, including:

- Corporate Profits: As companies become more efficient and innovative, their profits have increased, leading to higher stock prices.

- Economic Growth: The US economy has grown steadily over the past few decades, providing a strong foundation for the stock market.

- Low Interest Rates: Low-interest rates have made borrowing cheaper, allowing companies to invest in expansion and growth.

Future Outlook

Looking ahead, the overall US stock market faces several challenges and opportunities. Key factors to consider include:

- Global Economic Uncertainty: Issues like trade wars and political instability can impact the global economy and, in turn, the US stock market.

- Technological Innovation: The technology sector remains a major driver of growth, with companies like Google, Facebook, and Tesla leading the charge.

- Dividends and Stock Buybacks: Companies are increasingly returning profits to shareholders through dividends and stock buybacks, which can boost stock prices.

Case Study: The Great Recession

One of the most significant events in the history of the overall US stock market was the 2008 financial crisis, commonly referred to as the Great Recession. This crisis was caused by a combination of factors, including the bursting of the housing bubble and excessive risk-taking by financial institutions.

As a result, the stock market experienced a significant decline. However, it quickly recovered, with the S&P 500 Index reaching an all-time high in 2019. This example highlights the resilience of the US stock market and its ability to bounce back from adversity.

Conclusion

The overall US stock market is a complex and dynamic entity that plays a vital role in the global economy. By understanding its structure, performance, and future outlook, investors can make informed decisions and navigate the complexities of the stock market. Whether you're a seasoned investor or just starting out, the US stock market offers a wealth of opportunities and challenges.

us stock market live