Title: Can U.S. Citizens Invest in Indian Stocks?

author:US stockS -

Are you an American investor looking to diversify your portfolio? Have you ever considered investing in Indian stocks? In this article, we'll explore whether U.S. citizens can invest in Indian stocks, the process involved, and the potential benefits and risks.

Understanding the Basics

What are Indian Stocks?

Indian stocks refer to shares of companies listed on Indian stock exchanges, such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). These exchanges are among the world's largest and most vibrant, offering a wide range of investment opportunities.

Can U.S. Citizens Invest in Indian Stocks?

Yes, U.S. citizens can invest in Indian stocks. However, there are certain regulations and procedures that need to be followed.

Regulations and Procedures

Foreign Portfolio Investor (FPI) Status: U.S. citizens can invest in Indian stocks by obtaining a Foreign Portfolio Investor (FPI) status. This status allows foreign investors to invest in Indian stocks without any restrictions.

Dollar-Rupee Exchange Rate: Since Indian stocks are denominated in rupees, U.S. investors will need to convert their dollars to rupees. This can be done through a bank or a currency exchange service.

Brokerage and Custodian Services: U.S. investors will need to open a brokerage account with a firm that offers access to Indian stock exchanges. They will also need to engage a custodian to hold their Indian stocks.

Benefits of Investing in Indian Stocks

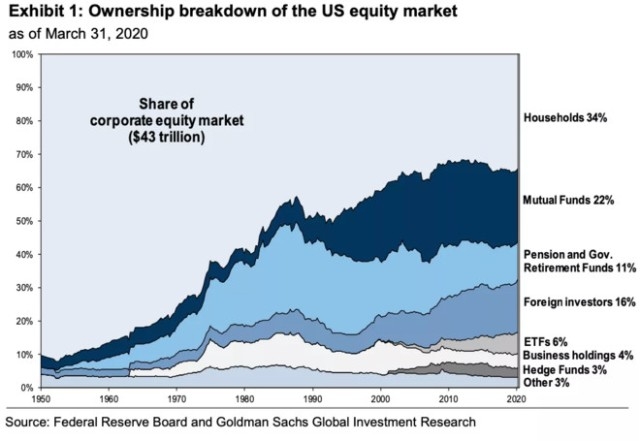

Diversification: Investing in Indian stocks can help diversify your portfolio, reducing the risk associated with investing in a single market.

High Growth Potential: India has one of the fastest-growing economies in the world, offering significant potential for investment returns.

Low Correlation with U.S. Markets: Indian stocks often have a low correlation with U.S. markets, making them a good hedge against market volatility.

Risks of Investing in Indian Stocks

Political and Economic Risks: India faces political and economic risks, such as policy changes and currency fluctuations, which can impact the performance of Indian stocks.

Regulatory Risks: U.S. investors need to be aware of the regulatory environment in India, as it can impact their investments.

Case Study: Facebook's Investment in Reliance Jio

In 2019, Facebook invested $5.7 billion in Reliance Jio, a leading Indian telecommunications company. This investment was part of Facebook's strategy to expand its presence in the Indian market. The move paid off, as Reliance Jio's stock price surged following the investment.

Conclusion

In conclusion, U.S. citizens can invest in Indian stocks by obtaining an FPI status, converting their dollars to rupees, and engaging a brokerage and custodian. While there are risks involved, the potential benefits of investing in Indian stocks make it an attractive option for diversification and high growth potential.

us stock market live