Stocks That Benefit from a Weak US Dollar

author:US stockS -

In today's globalized economy, the value of the US dollar plays a crucial role in the stock market. When the dollar weakens, it can have a significant impact on various sectors and individual stocks. This article explores the stocks that benefit from a weak US dollar, providing investors with valuable insights into capitalizing on this economic trend.

Understanding the Weak US Dollar

A weak US dollar means that it has lost value compared to other currencies. This can occur due to several factors, including low interest rates, economic uncertainty, or strong demand for other currencies. When the dollar weakens, it makes US exports more competitive and can boost the earnings of companies with significant international exposure.

Key Sectors Benefiting from a Weak US Dollar

Several sectors are particularly sensitive to changes in the US dollar's value. Here are some of the key sectors that tend to benefit from a weak US dollar:

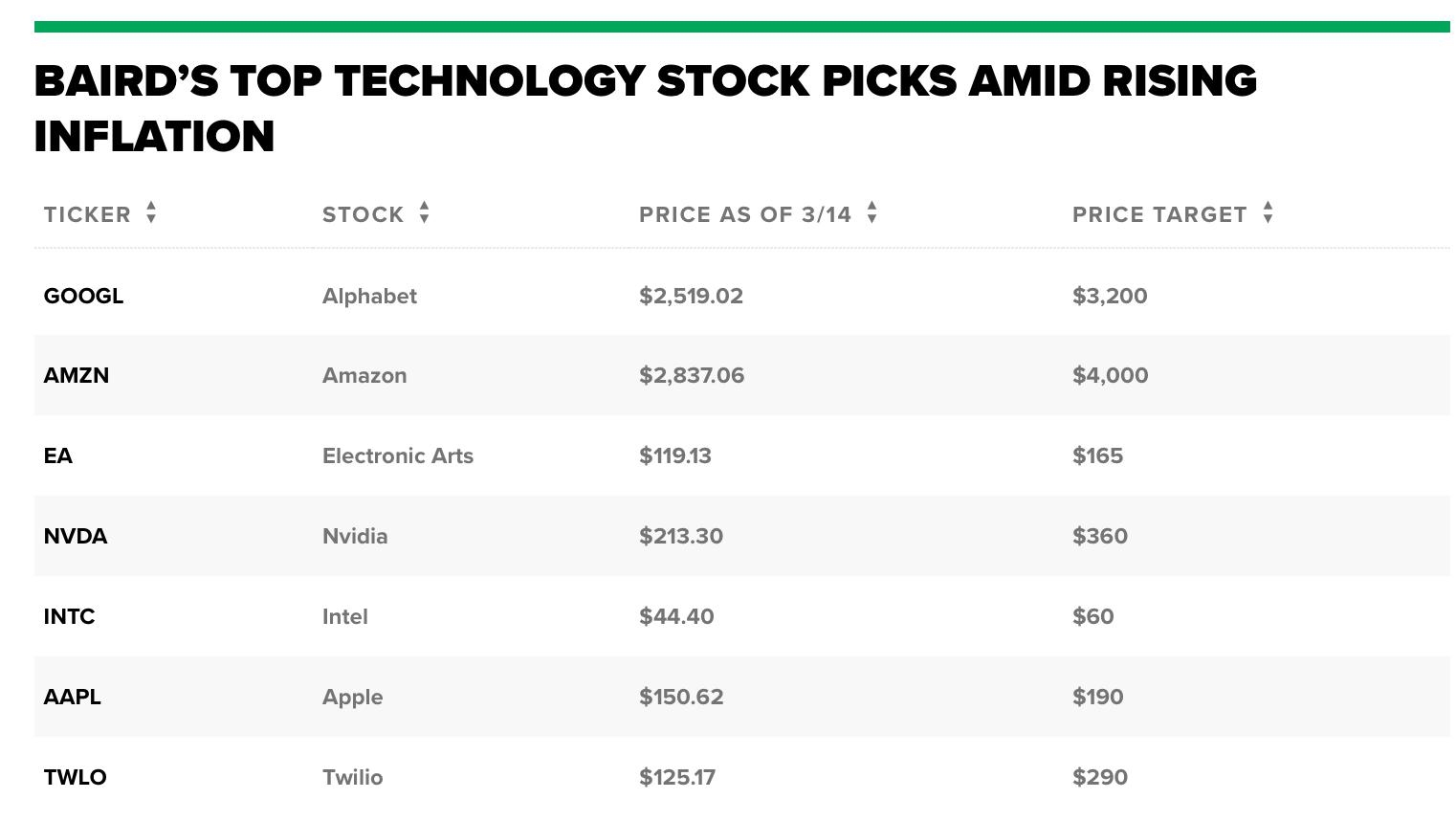

1. Technology Stocks

Technology companies often generate a significant portion of their revenue from international markets. A weak US dollar makes their products more affordable and competitive abroad, leading to increased sales and higher earnings. Apple (AAPL), Microsoft (MSFT), and Intel (INTC) are some notable technology stocks that benefit from a weak US dollar.

2. Energy Stocks

The energy sector is heavily influenced by currency fluctuations, particularly for oil and gas companies. A weak US dollar makes oil and natural gas cheaper in other countries, boosting demand and profitability. ExxonMobil (XOM), Chevron (CVX), and Royal Dutch Shell (RDS.A) are prominent energy stocks that stand to benefit from a weak US dollar.

3. Consumer Discretionary Stocks

Consumer discretionary companies, such as retailers and luxury goods manufacturers, also benefit from a weak US dollar. A weaker dollar makes imported goods more expensive, which can drive consumers to purchase domestic products. Nike (NKE), Disney (DIS), and Home Depot (HD) are some well-known consumer discretionary stocks that can benefit from a weak US dollar.

4. Financial Stocks

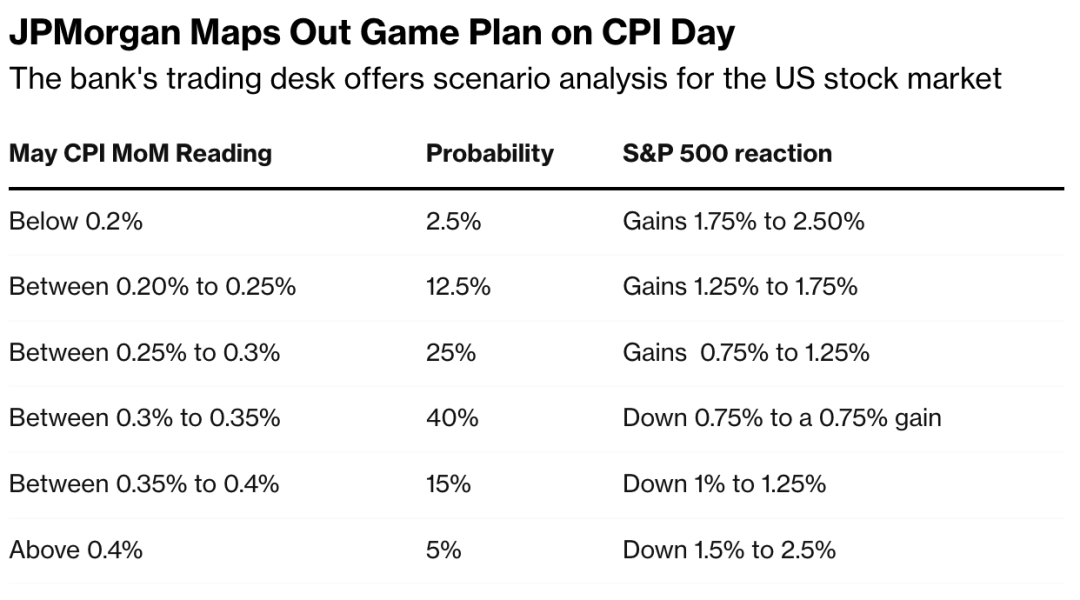

A weak US dollar can also benefit financial institutions, particularly those with significant international exposure. Banks and insurance companies may see increased revenue from foreign operations due to the weaker dollar. JPMorgan Chase (JPM), Bank of America (BAC), and American Express (AXP) are some financial stocks that can benefit from a weak US dollar.

Case Studies

To illustrate the impact of a weak US dollar on individual stocks, let's consider a few case studies:

Apple (AAPL): In 2020, when the US dollar weakened, Apple's revenue from international markets increased significantly. This helped the company achieve record-breaking revenue and earnings, despite the global pandemic.

ExxonMobil (XOM): A weak US dollar has historically benefited ExxonMobil's earnings. In 2016, when the dollar weakened, the company's profits from international oil and gas operations surged.

Nike (NKE): Nike has seen a strong correlation between a weak US dollar and increased sales in international markets. A weaker dollar makes Nike's products more affordable and competitive abroad, leading to higher revenue and earnings.

In conclusion, a weak US dollar can have a significant impact on the stock market, particularly for companies with international exposure. By focusing on sectors such as technology, energy, consumer discretionary, and financials, investors can identify stocks that stand to benefit from a weak US dollar.

us stock market live