Standard Chartered US Stock Price: An In-Depth Analysis

author:US stockS -

In the world of finance, the stock market is a key indicator of a company's performance and its potential for growth. One such company that has garnered significant attention from investors is Standard Chartered, a British multinational banking and financial services company. In this article, we will delve into the Standard Chartered US stock price, analyzing its trends, factors that influence it, and potential future movements.

Understanding Standard Chartered

Standard Chartered is one of the world's leading emerging markets banks, serving clients in 70 countries across the globe. The company operates primarily in Asia, Africa, and the Middle East, with a significant presence in the United States. Its diverse range of financial services includes retail, corporate, and institutional banking.

The Stock Price: What You Need to Know

The Standard Chartered US stock price has been fluctuating over the years, influenced by various factors such as market trends, economic conditions, and company performance. Understanding these factors can help investors make informed decisions.

Historical Performance

Historical performance is an essential factor in analyzing the stock price. Over the past few years, the stock has seen significant ups and downs, reflecting the broader market's volatility and the company's performance.

For instance, during the financial crisis of 2008, the stock price took a hit, dropping significantly. However, it has since recovered and shown resilience. Investors often look at the company's financial statements, such as revenue, earnings per share, and debt levels, to gauge its performance.

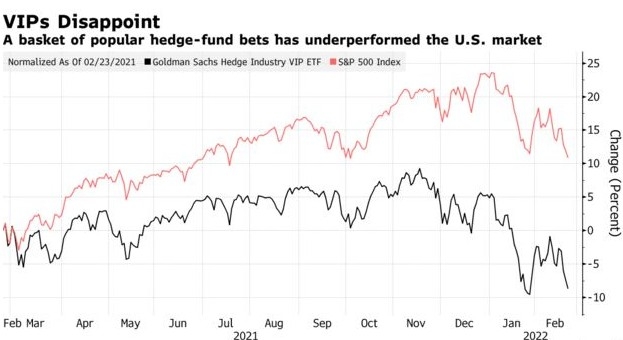

Market Trends

Market trends play a crucial role in influencing the stock price. Market trends include factors such as inflation rates, interest rates, and geopolitical events. For example, during periods of high inflation, banks may face challenges due to the increased cost of borrowing.

Moreover, the Standard Chartered US stock price can be influenced by the performance of emerging markets. Since the company operates in these regions, any economic turmoil or growth in these markets can directly impact its stock price.

Economic Conditions

Economic conditions in the United States and other regions where Standard Chartered operates can significantly impact its stock price. For instance, a strong economy often leads to increased corporate earnings, benefiting financial institutions like Standard Chartered.

However, economic downturns can lead to reduced demand for banking services and lower corporate earnings, affecting the stock price. Investors often monitor key economic indicators, such as GDP growth, unemployment rates, and inflation, to gauge economic conditions.

Potential Future Movements

Predicting the future movement of the Standard Chartered US stock price is challenging. However, several factors could potentially influence its future trajectory.

Expansion into New Markets

Standard Chartered has been actively expanding into new markets, particularly in Africa and Asia. If the company successfully penetrates these markets, it could lead to increased revenue and, subsequently, a rise in the stock price.

Technological Advancements

Technological advancements have been revolutionizing the banking industry. Standard Chartered has been investing in technology to enhance its services and improve customer experience. If these efforts pay off, the stock price could see a positive impact.

Regulatory Changes

Regulatory changes in the banking sector can have a significant impact on the stock price. Standard Chartered must comply with various regulations, and any changes in these regulations can either benefit or harm the company's bottom line.

Conclusion

Analyzing the Standard Chartered US stock price requires a comprehensive understanding of various factors, including historical performance, market trends, economic conditions, and potential future movements. While predicting the stock's future is challenging, investors can gain valuable insights by keeping an eye on these factors. By doing so, they can make informed decisions and potentially benefit from the company's growth and performance.

us stock market live