Russian Stock US: Understanding the Impact and Opportunities

author:US stockS -

In today's globalized economy, the integration of international markets is more significant than ever. One such integration is the relationship between the Russian stock market and the United States. This article delves into the implications and opportunities that arise from this unique connection, highlighting key factors for investors to consider.

The Russian Stock Market

The Russian stock market, often referred to as the MICEX or RTS index, is one of the largest in Eastern Europe. It consists of various sectors, including energy, metals, and telecommunications. Russian stocks have been a topic of interest for investors due to their potential growth and unique market dynamics.

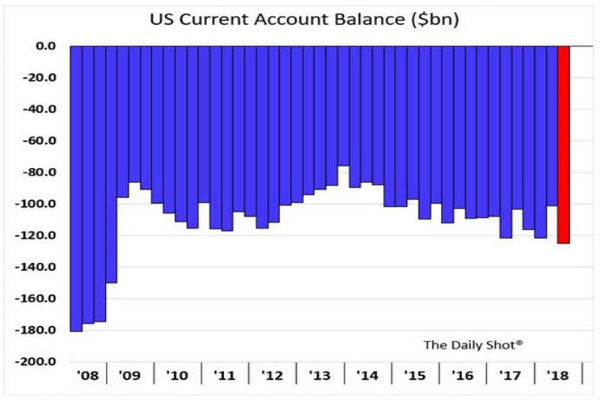

Impact on the US Market

The relationship between the Russian stock market and the US is multifaceted. On one hand, sanctions imposed by the US government on Russia have created uncertainty and volatility in the market. On the other hand, these sanctions have also led to increased demand for Russian assets among some investors who see value in undervalued stocks.

Opportunities for Investors

Despite the challenges, there are several opportunities for investors to benefit from the Russian stock market. Here are a few key areas to consider:

Energy Sector: Russia is one of the world's largest exporters of oil and natural gas. The energy sector in Russia is often considered a safe haven during global economic downturns, as it is essential for industrial development.

Metals Industry: Russia is a significant producer of metals, including palladium, platinum, and copper. These commodities are essential for various industries, and an increase in demand can drive up the value of Russian metal stocks.

Technology and Telecommunications: The technology and telecommunications sectors in Russia have seen significant growth in recent years. Companies in these sectors have the potential for strong returns, especially as the digital economy continues to expand.

Case Studies

To illustrate the potential of Russian stocks, let's look at a few case studies:

Lukoil: Lukoil is one of Russia's largest oil companies and a leading player in the global energy market. Despite the sanctions, Lukoil has continued to perform well, demonstrating the resilience of the energy sector in Russia.

Sberbank: Sberbank is Russia's largest bank and one of the most influential financial institutions in the country. It has shown significant growth and is considered a key investment opportunity in the Russian market.

Yandex: Yandex is Russia's largest internet company and a major player in the global tech market. It operates in various sectors, including search engines, e-commerce, and transportation services.

Conclusion

Investing in Russian stocks can be complex due to geopolitical and economic uncertainties. However, with careful analysis and a long-term perspective, investors can identify opportunities for significant returns. By focusing on key sectors such as energy, metals, and technology, investors can capitalize on the potential growth of the Russian stock market.

Remember, it's crucial to conduct thorough research and stay informed about the latest developments in both the Russian and global markets. With the right approach, Russian stocks can be a valuable addition to any investment portfolio.

us stock market live