Oil Price NASDAQ: A Comprehensive Analysis

author:US stockS -

In the ever-evolving global market, the correlation between oil prices and the NASDAQ Composite Index is a subject of significant interest. This article delves into the intricate relationship between these two financial entities, offering insights into how they impact each other. By understanding this correlation, investors can make informed decisions and capitalize on market trends.

Understanding the NASDAQ Composite Index

The NASDAQ Composite Index is a widely followed stock market index that tracks the performance of over 3,000 companies listed on the NASDAQ Stock Market. It represents a broad range of industries, including technology, biotechnology, telecommunications, and consumer services. The index is often seen as a bellwether for the health of the technology sector and the broader economy.

The Influence of Oil Prices on the NASDAQ

Oil prices have a profound impact on the NASDAQ Composite Index due to the index's heavy representation of technology and energy companies. Here are some key factors to consider:

Energy Sector Influence: The energy sector, which includes oil and gas companies, is a significant component of the NASDAQ. As oil prices fluctuate, these companies' stock prices can move accordingly, thereby affecting the overall index.

Economic Indicators: Oil prices are a crucial economic indicator. They influence inflation, consumer spending, and business investment. A rise in oil prices can lead to higher production costs and reduced consumer spending, which can negatively impact the NASDAQ.

Tech Sector Vulnerability: The technology sector, a major component of the NASDAQ, is vulnerable to changes in oil prices. For instance, rising oil prices can lead to higher transportation costs, which can affect the profitability of tech companies that rely on shipping and logistics.

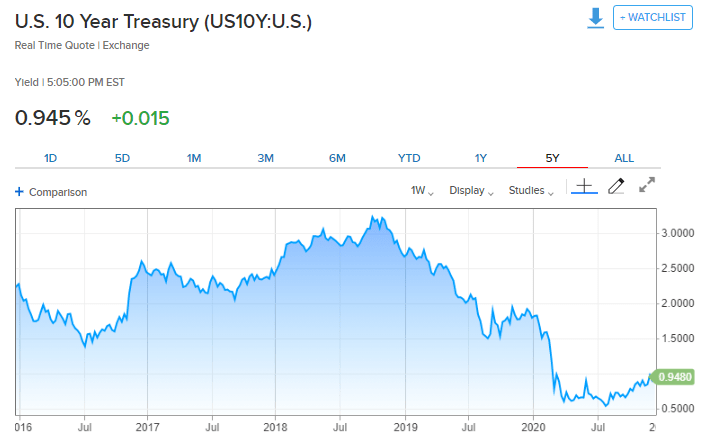

Case Study: The 2020 Oil Price Crash

A notable example of the relationship between oil prices and the NASDAQ is the 2020 oil price crash. In April 2020, oil prices plummeted to negative territory for the first time in history due to a supply glut and plummeting demand. This crash had a significant impact on the NASDAQ Composite Index, which fell sharply during the same period.

The crash highlighted the vulnerability of the technology sector to oil price fluctuations. Many tech companies rely on energy-intensive manufacturing processes and transportation, making them sensitive to changes in oil prices.

Investment Implications

Understanding the correlation between oil prices and the NASDAQ is crucial for investors. Here are some key takeaways:

Diversification: Investors should consider diversifying their portfolios to mitigate the risk associated with fluctuations in oil prices. This can include investing in sectors that are less sensitive to oil prices, such as consumer goods and healthcare.

Market Timing: Keeping an eye on oil prices can help investors make informed decisions about when to enter or exit the market. For instance, when oil prices are high, the NASDAQ may be at risk of a downturn, while lower oil prices could present a buying opportunity.

Long-Term Perspective: While short-term fluctuations in oil prices can impact the NASDAQ, it's important to maintain a long-term perspective. The NASDAQ has historically shown resilience in the face of economic challenges, including those related to oil prices.

In conclusion, the relationship between oil prices and the NASDAQ Composite Index is a complex and multifaceted one. By understanding this correlation, investors can make more informed decisions and navigate the global market with greater confidence.

us stock market live