Non-US Citizen Access to the US Stock Market

author:US stockS -

Embarking on the world of investing can be a daunting task, especially for non-US citizens who are interested in the dynamic and lucrative US stock market. The allure of American companies and the potential for high returns is undeniable, but navigating the complexities of international investment can seem overwhelming. In this article, we'll explore how non-US citizens can gain access to the US stock market, the regulations they need to be aware of, and some valuable insights to get started.

Understanding the Basics

Before diving into the details, it's essential to understand the basics. The US stock market is home to numerous public companies across various industries, ranging from technology giants like Apple and Google to renowned pharmaceutical companies like Pfizer. As a non-US citizen, you can invest in these companies by purchasing their stocks, which represent a portion of the company's ownership.

Opening an Investment Account

To start investing in the US stock market, non-US citizens will need to open a brokerage account with a registered US brokerage firm. This account will allow you to buy and sell stocks, track your investments, and access other investment products.

When choosing a brokerage firm, consider factors such as fees, customer service, and the availability of investment options. Some popular brokers for international investors include Charles Schwab, TD Ameritrade, and E*TRADE.

Regulations to Keep in Mind

As a non-US citizen, you'll need to be aware of certain regulations when investing in the US stock market. These include:

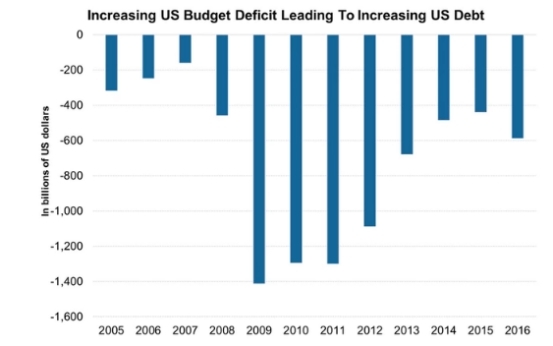

Tax Implications: Non-US citizens are subject to US tax laws on their investment income, including dividends and capital gains. It's crucial to consult with a tax professional to understand your tax obligations and ensure compliance.

Form W-8: To avoid unnecessary tax withholdings, you'll need to complete Form W-8BEN, which certifies your foreign status to the IRS.

Residency Status: Depending on your residency status, you may be subject to different tax regulations. For example, resident aliens are taxed differently than non-resident aliens.

Investment Strategies for Non-US Citizens

Once you've opened an investment account and familiarized yourself with the regulations, it's time to develop an investment strategy. Here are some tips to consider:

Diversification: Invest in a variety of companies across different industries and geographic locations to mitigate risk.

Research and Analysis: Conduct thorough research on the companies you're interested in investing in. Pay attention to financial statements, management, and market trends.

Long-Term Perspective: The US stock market can be volatile, so it's important to adopt a long-term investment horizon. Avoid making impulsive decisions based on short-term market fluctuations.

Case Study: Investing in Apple Inc.

To illustrate the process, let's consider a hypothetical scenario. Imagine a non-US citizen who has always admired Apple Inc.'s innovative products. After conducting thorough research, they decide to invest in Apple's stock.

First, they open a brokerage account with a reputable US broker. Once the account is set up, they deposit funds and use the platform to purchase Apple shares.

Over time, they monitor their investment and witness the company's growth. Apple continues to launch successful products and expand its market presence, leading to a significant increase in the stock price. As a result, the non-US citizen's investment appreciates, providing them with a valuable opportunity for growth and diversification.

Conclusion

Investing in the US stock market as a non-US citizen is possible with the right approach and knowledge. By opening a brokerage account, understanding the regulations, and developing a well-thought-out investment strategy, non-US citizens can take advantage of the numerous opportunities available in the US stock market.

us stock market live