Is It Good to Invest in US Stocks Now?

author:US stockS -

In today's volatile financial market, many investors are left pondering whether it's a good time to invest in US stocks. With the ongoing pandemic and economic uncertainties, making the right investment decision can be daunting. However, understanding the current market trends and analyzing the factors that influence stock prices can provide valuable insights. This article will delve into the factors you should consider before deciding to invest in US stocks.

Economic Recovery and Growth

The US economy has shown signs of recovery, with several sectors performing well. The Federal Reserve has been actively implementing policies to support economic growth, which has led to lower interest rates. Lower interest rates can stimulate investment and boost stock prices. Additionally, the government's stimulus packages have provided relief to businesses and consumers, further contributing to economic recovery.

Sector Performance

When considering investing in US stocks, it's crucial to analyze the performance of different sectors. Some sectors, such as technology, healthcare, and consumer discretionary, have performed exceptionally well in recent years. On the other hand, sectors like energy and real estate have faced challenges due to the pandemic. It's essential to research and identify sectors that are poised for growth to maximize your investment returns.

Dividend Yield

Dividend yields can be a compelling reason to invest in US stocks. Dividends are regular payments made by companies to their shareholders, and they can provide a steady source of income. Companies with high dividend yields tend to be more stable and have a lower risk of failure. Before investing, ensure that the company you're considering has a strong track record of paying dividends and has a solid financial foundation.

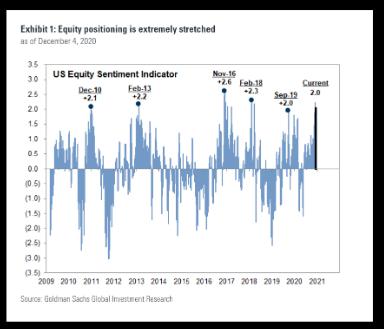

Market Trends and Indicators

Analyzing market trends and indicators can provide valuable insights into the potential performance of US stocks. For instance, the S&P 500 and the Dow Jones Industrial Average are two widely followed stock market indices that can give you an idea of the overall market sentiment. Additionally, economic indicators like GDP growth, unemployment rates, and inflation can influence stock prices.

Historical Performance

Understanding the historical performance of US stocks can be beneficial when making investment decisions. While past performance is not a guarantee of future results, it can provide a sense of stability and predictability. Look for companies with a strong track record of growth and profitability.

Case Study: Apple Inc.

Let's take a look at a well-known company, Apple Inc., as an example. Apple has consistently delivered strong financial results, and its stock has performed well over the years. The company's focus on innovation, strong brand loyalty, and diverse product line have contributed to its success. By analyzing Apple's financial statements and market trends, investors can gain insights into the potential of investing in the company.

In conclusion, investing in US stocks can be a good opportunity for growth and income, but it's essential to conduct thorough research and consider various factors before making a decision. The current economic recovery, sector performance, dividend yields, market trends, historical performance, and company fundamentals are all crucial aspects to consider. By carefully analyzing these factors, you can make informed investment decisions and potentially achieve your financial goals.

us stock market live