Investing in US Stocks from India: A Comprehensive Guide

author:US stockS -

Introduction

Investing in US stocks from India can be a lucrative opportunity for investors looking to diversify their portfolios and tap into the world's largest and most robust stock market. With the rise of online trading platforms and the globalization of financial markets, investing in US stocks has become more accessible than ever. This guide will provide you with a comprehensive overview of the process, key considerations, and tips for successfully investing in US stocks from India.

Understanding the US Stock Market

The US stock market is a significant part of the global financial system, with a market capitalization of over $33 trillion. It is home to some of the world's largest and most successful companies, including Apple, Microsoft, and Amazon. The US stock market is divided into two primary exchanges: the New York Stock Exchange (NYSE) and the NASDAQ.

Choosing a Broker

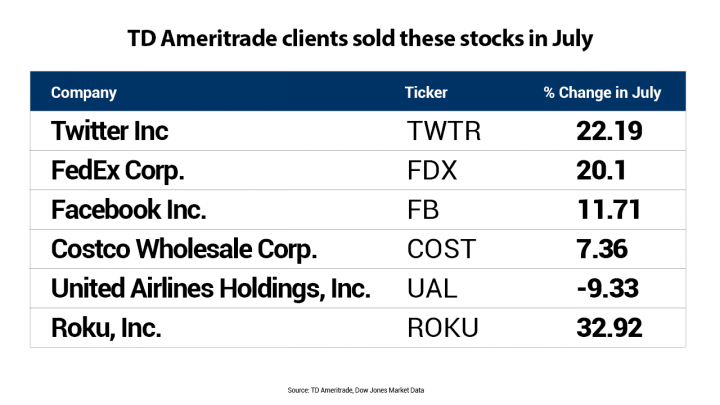

To invest in US stocks from India, you need to open a brokerage account with a reputable online broker. Several brokers offer services for Indian investors, including TD Ameritrade, E*TRADE, and Fidelity. When choosing a broker, consider factors such as fees, customer service, and the range of investment options available.

Understanding Risk and Reward

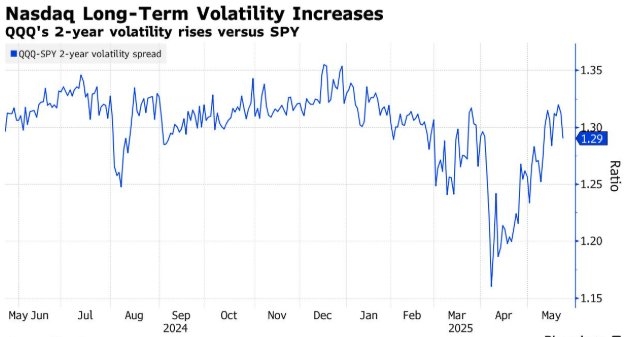

Investing in US stocks carries both risks and rewards. While the US stock market has historically provided strong returns, it can also be volatile. It is crucial to understand the risks involved and to invest only the amount you can afford to lose. Diversifying your portfolio across different sectors and asset classes can help mitigate risk.

Key Considerations for Indian Investors

Currency Conversion: When investing in US stocks, you will need to convert your Indian rupees to US dollars. Be aware of the exchange rate and any associated fees.

Tax Implications: Indian investors must pay taxes on capital gains from US stock investments. It is essential to understand the tax laws and consult with a tax professional if needed.

Trading Hours: The US stock market operates from 9:30 AM to 4:00 PM Eastern Time. Be aware of the trading hours and plan your investments accordingly.

Research and Analysis: Conduct thorough research and analysis before investing in any stock. Consider factors such as the company's financial health, market trends, and industry outlook.

Tips for Successful Investing

Start Small: If you are new to investing in US stocks, start with a small amount and gradually increase your investment as you gain confidence and experience.

Stay Informed: Keep up with the latest news and developments in the US stock market and the companies you are invested in.

Review Your Portfolio Regularly: Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance.

Consider Dividend Stocks: Dividend stocks can provide a steady stream of income and may offer more stability than growth stocks.

Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses on your investments.

Conclusion

Investing in US stocks from India can be a rewarding investment opportunity. By understanding the process, conducting thorough research, and managing risk effectively, you can build a diversified portfolio and potentially achieve strong returns. Remember to choose a reputable broker, stay informed, and consult with a financial advisor if needed.

us stock market live