Current US Stock Market Ticker: A Comprehensive Overview

author:US stockS -

In the ever-evolving world of finance, staying updated with the current US stock market ticker is crucial for investors and traders. This article delves into the latest trends, key players, and essential insights of the US stock market, providing you with a comprehensive overview.

Understanding the US Stock Market Ticker

The US stock market ticker, also known as the stock market index, is a numerical indicator that reflects the performance of a group of stocks. It provides a snapshot of the overall market's direction and can be used to gauge investor sentiment and market trends. The most widely followed US stock market tickers include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

Key Stock Market Tickers and Their Significance

S&P 500: This index tracks the performance of 500 large companies listed on stock exchanges in the United States. It is often considered a benchmark for the overall health of the US stock market. The S&P 500 has a diverse range of sectors, making it a comprehensive indicator of market trends.

Dow Jones Industrial Average (DJIA): The DJIA is a price-weighted average of 30 large, publicly-owned companies in the United States. It includes companies from various sectors, such as technology, finance, and healthcare. The DJIA is often used as a gauge of the broader market's performance.

NASDAQ Composite: This index tracks the performance of all domestic and international common stocks listed on the NASDAQ stock exchange. It is particularly relevant for technology companies and is considered a leading indicator of the tech sector's performance.

Current Trends in the US Stock Market

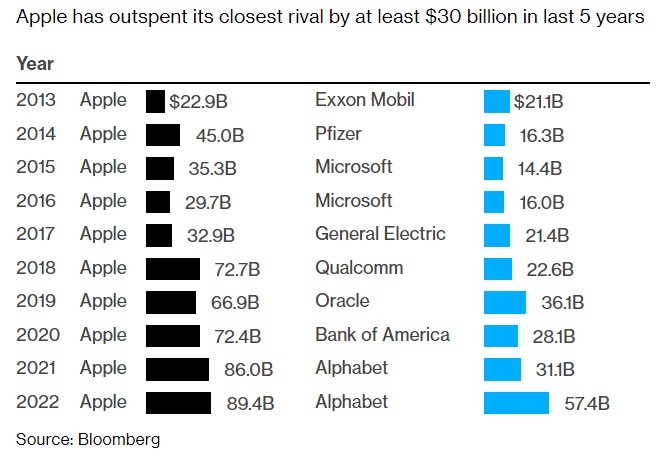

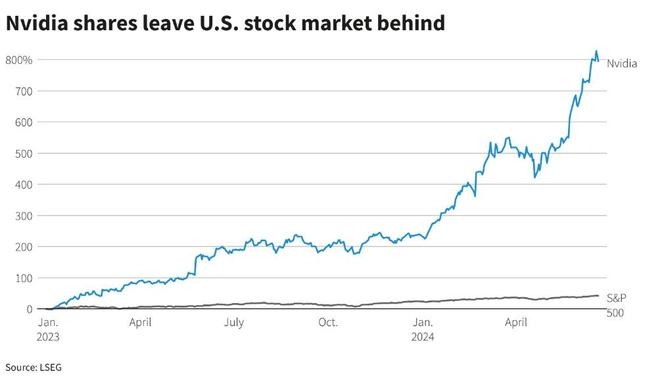

Tech Stocks: Over the past few years, tech stocks have been a major driver of the US stock market. Companies like Apple, Microsoft, and Amazon have seen significant growth, contributing to the overall market's performance. However, recent regulatory scrutiny and economic uncertainties have caused some volatility in this sector.

Value Stocks: Value stocks, which are undervalued relative to their fundamentals, have been gaining traction recently. Investors are seeking out companies with strong fundamentals and potential for growth, particularly in the wake of the COVID-19 pandemic.

Economic Recovery: As the US economy continues to recover from the pandemic, investors are closely monitoring the performance of key sectors, such as energy, financials, and consumer discretionary. The success of these sectors will play a significant role in the overall market's direction.

Case Studies: Impact of Stock Market Tickers on Investment Decisions

Tesla, Inc. (TSLA): Tesla, a leading electric vehicle manufacturer, has seen its stock soar in recent years. Its inclusion in the NASDAQ Composite has made it a key player in the tech sector and has influenced the overall performance of the index.

Bank of America Corporation (BAC): As one of the largest banks in the United States, Bank of America has a significant impact on the financial sector and the broader market. Its performance is closely monitored by investors and is often reflected in the DJIA.

Conclusion

Staying informed about the current US stock market ticker is essential for making informed investment decisions. By understanding the key stock market tickers and their significance, investors can gain valuable insights into market trends and make strategic decisions to maximize their returns.

us stock market live