Copper Stocks in the US Market: A Comprehensive Guide

author:US stockS -

In the ever-evolving landscape of the US stock market, copper stocks have always held a significant position. Copper, known as the "blue metal," is a vital component in various industries, making copper stocks a lucrative investment opportunity. This article delves into the intricacies of copper stocks in the US market, highlighting key factors, investment strategies, and notable companies.

Understanding Copper Stocks

Copper stocks represent shares of companies that mine, process, or produce copper. These stocks are typically listed on major US stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. Investing in copper stocks can be beneficial due to the metal's widespread use in construction, electrical, and manufacturing sectors.

Key Factors Influencing Copper Stocks

Several factors can impact the performance of copper stocks:

Global Demand: The demand for copper is closely tied to the global economy. Rising demand from emerging markets like China and India can drive up copper prices and, subsequently, the value of copper stocks.

Supply Constraints: Supply disruptions due to political instability, labor strikes, or natural disasters can lead to a scarcity of copper, causing prices to soar and benefiting copper stocks.

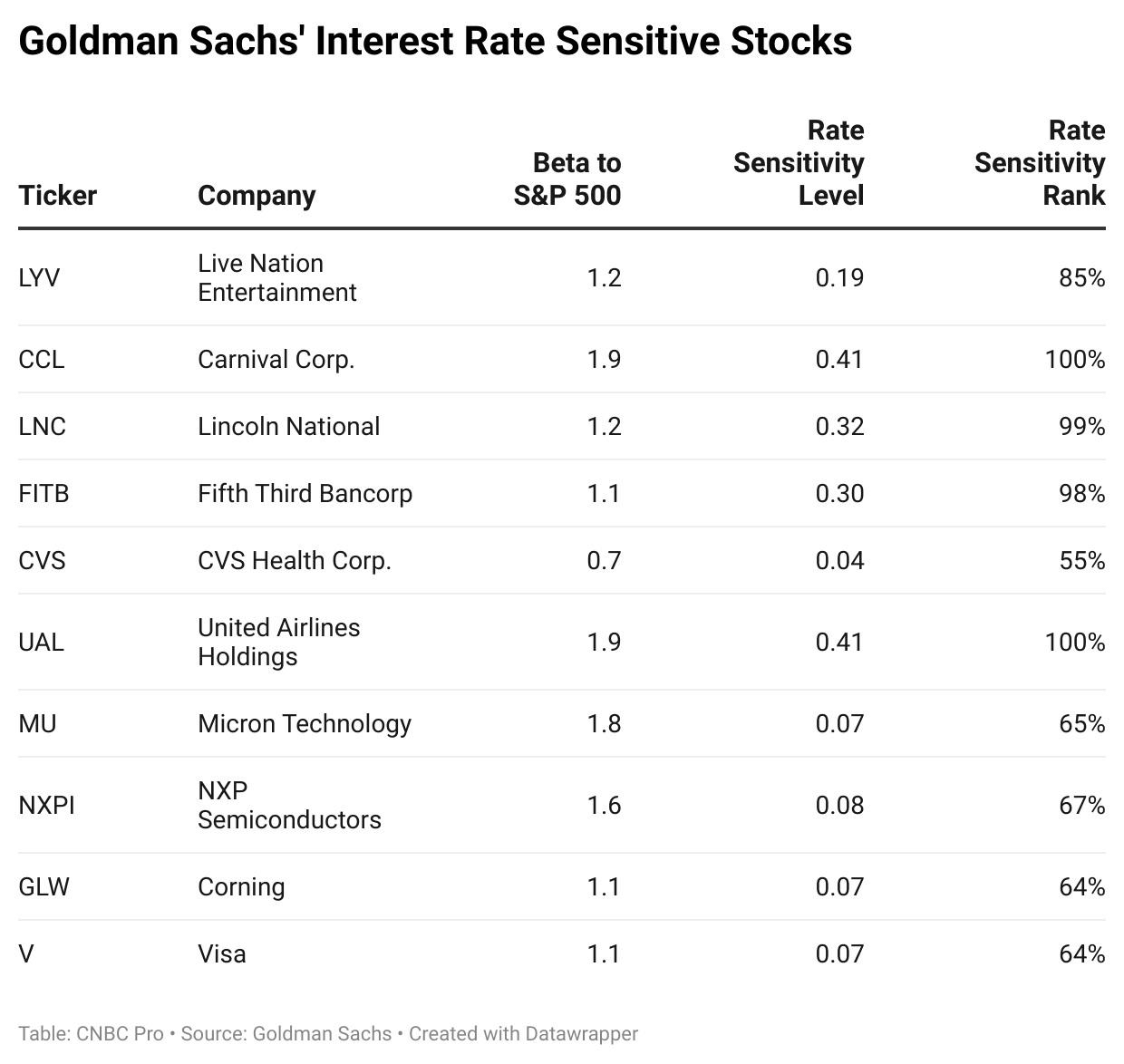

Interest Rates: Interest rates play a crucial role in the copper market. Higher interest rates can lead to increased borrowing costs for companies, potentially affecting their profitability and, consequently, the value of their stocks.

Commodity Prices: Copper prices are highly correlated with other commodity prices, such as oil and gold. Fluctuations in these prices can impact copper stocks.

Investment Strategies for Copper Stocks

Investing in copper stocks requires a well-thought-out strategy. Here are some key strategies to consider:

Diversification: Diversifying your portfolio with copper stocks can help mitigate risks associated with market volatility.

Long-Term Investing: Long-term investing in copper stocks can be beneficial, as the metal's demand is expected to grow over time.

Research and Analysis: Conduct thorough research and analysis before investing in copper stocks. Consider factors such as the company's financial health, management team, and market position.

Market Trends: Stay informed about market trends and economic indicators that can impact copper prices and, subsequently, the value of copper stocks.

Notable Copper Stocks in the US Market

Several companies have a strong presence in the US copper market. Here are some notable examples:

Freeport-McMoRan Inc. (FCX): As one of the world's largest copper producers, Freeport-McMoRan has a significant impact on the copper market.

BHP Billiton Ltd. (BHP): BHP Billiton is a leading global resources company with a substantial copper production portfolio.

Rio Tinto (RIO): Rio Tinto is another major player in the copper industry, with operations spanning the globe.

Southern Copper Corporation (SCCO): Southern Copper is a significant producer of copper in the US and Latin America.

Conclusion

Copper stocks in the US market offer a unique investment opportunity due to the metal's widespread use and economic importance. By understanding key factors, adopting sound investment strategies, and staying informed about market trends, investors can make informed decisions and potentially benefit from the growth of the copper industry.

us stock market live