China Buy US Stocks: The Growing Economic Ties

author:US stockS -

In recent years, there has been a significant shift in the global economic landscape, particularly in the relationship between China and the United States. One of the most notable developments has been the increase in Chinese investment in US stocks. This article delves into the reasons behind this trend, its impact on both economies, and the potential future of this growing partnership.

Why China is Buying US Stocks

Economic Stability and Diversification

One of the primary reasons why China is increasingly investing in US stocks is the pursuit of economic stability and diversification. The Chinese economy has been growing at a rapid pace, but it also faces several challenges, including over-reliance on exports, environmental concerns, and a potential slowdown. By investing in the US stock market, China aims to diversify its investment portfolio and reduce its dependence on domestic markets.

Access to High-Quality Companies

The US stock market is home to some of the world's most successful and innovative companies, including tech giants like Apple, Microsoft, and Google. Chinese investors are attracted to these companies due to their strong financial performance, growth potential, and technological advancements. By investing in these stocks, Chinese investors gain access to high-quality companies that can potentially offer substantial returns.

Rising Yuan and Foreign Exchange Reserves

Another factor contributing to China's increased investment in US stocks is the rising value of the Chinese yuan and the country's significant foreign exchange reserves. As the yuan strengthens, Chinese investors can purchase more US dollars with their yuan, allowing them to buy more US stocks. Additionally, the Chinese government has been actively managing its foreign exchange reserves, and investing in US stocks can be a strategic way to deploy these reserves effectively.

Impact on the US Economy

The growing Chinese investment in US stocks has several positive impacts on the US economy.

Job Creation and Economic Growth

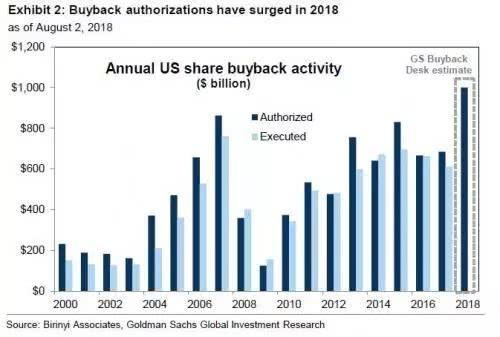

Investment in US stocks often leads to increased capital investment, job creation, and economic growth. When Chinese investors purchase stocks, they contribute to the capital markets, which can lead to more investment in businesses across various sectors. This, in turn, can lead to job creation and economic growth in the US.

Competitive Advantage for US Companies

Chinese investment in US stocks can also provide a competitive advantage for US companies. With increased funding, these companies can expand their operations, invest in research and development, and compete more effectively in global markets.

Potential Risks and Challenges

While there are several benefits to Chinese investment in US stocks, there are also potential risks and challenges.

Political and Geopolitical Factors

Political and geopolitical tensions between China and the United States can impact Chinese investment in US stocks. Any escalation in trade disputes or diplomatic tensions could lead to a decrease in Chinese investment.

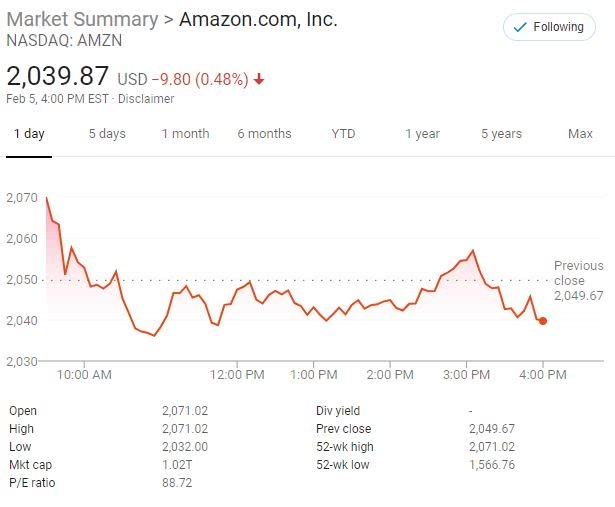

Economic Volatility

The global economy is subject to volatility, and any economic downturn could impact Chinese investment in US stocks. Additionally, fluctuations in currency exchange rates can also affect the value of these investments.

Conclusion

The growing Chinese investment in US stocks is a testament to the increasing economic ties between China and the United States. As both economies continue to evolve, it is essential to understand the benefits and challenges of this relationship. By fostering cooperation and mutual understanding, both countries can capitalize on the opportunities presented by this growing economic partnership.

us stock market live