Can the US Stock Market Ever End Like Japan?

author:US stockS -

Introduction

The stock market has been a cornerstone of the American economy, often hailed as a beacon of growth and prosperity. However, with its rollercoaster of ups and downs, many investors wonder: can the US stock market ever end like Japan? This article delves into this intriguing question, examining historical parallels, current market trends, and potential future scenarios.

Historical Parallels: The Japanese Stock Market Crash of 1989

To understand the possibility of a similar fate for the US stock market, it's crucial to look back at the Japanese stock market crash of 1989. The Japanese bubble, which began in the late 1980s, saw the Nikkei stock index soar to record highs. However, by the early 1990s, the bubble burst, leading to a prolonged period of economic stagnation and deflation.

Several factors contributed to the Japanese stock market crash:

- Overvaluation: The stock prices were significantly overvalued, driven by speculative buying and excessive leverage.

- Economic Policies: The Bank of Japan's tight monetary policy, aimed at curbing inflation, inadvertently led to deflation.

- Political Instability: Political indecision and lack of decisive action to address the crisis further exacerbated the situation.

Current Market Trends in the US

While the US stock market has experienced its fair share of volatility, it remains resilient compared to the Japanese market in the 1980s. However, there are several factors that could potentially lead to a similar scenario:

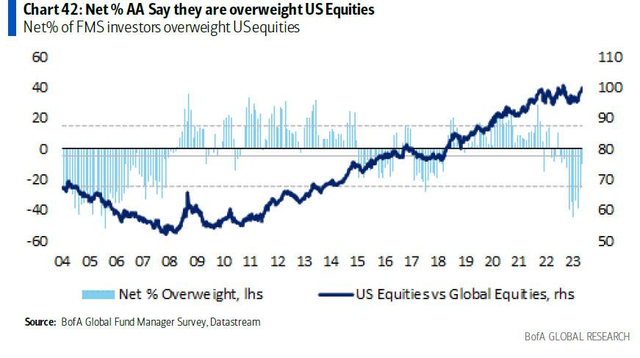

- Overvaluation: The US stock market has seen significant growth in recent years, driven by factors such as low-interest rates and excessive leverage. This has led to concerns about overvaluation, similar to the Japanese bubble.

- Economic Policies: The Federal Reserve's monetary policy has been a key driver of the stock market's growth. However, with inflation concerns on the rise, the Fed may need to adopt a more hawkish stance, potentially leading to market volatility.

- Political Instability: The US political landscape has become increasingly polarized, which could lead to policy gridlock and uncertainty.

Potential Future Scenarios

While the possibility of a US stock market crash similar to Japan cannot be ruled out, several factors could mitigate the risk:

- Diverse Economic Structure: The US economy is more diversified compared to Japan's economy in the 1980s, which could help absorb shocks and prevent a prolonged downturn.

- Strong Regulatory Environment: The US has a more robust regulatory framework in place, which could help prevent excessive risk-taking and speculative bubbles.

- Globalization: The US is a key player in the global economy, which could provide a cushion against domestic economic downturns.

Conclusion

The question of whether the US stock market can ever end like Japan remains a topic of debate. While there are several factors that could lead to a similar scenario, the resilience of the US economy and the lessons learned from the Japanese experience could help prevent a repeat of the 1980s. As investors, it's crucial to remain vigilant and stay informed about the latest market trends and economic developments.

us stock market live