Can Non-US Citizens Trade Stocks?

author:US stockS -

Are you a non-US citizen considering investing in the American stock market? If so, you've come to the right place. This article delves into whether or not non-US citizens can trade stocks in the United States and provides essential guidance on how to do so legally and effectively.

Understanding the Basics

First and foremost, it's crucial to understand that non-US citizens can indeed trade stocks in the US. However, there are certain regulations and requirements that must be met to ensure compliance with both American and international laws.

Legal Requirements for Non-US Citizens Trading Stocks

Tax Residency Status: One of the primary requirements for non-US citizens to trade stocks in the US is to establish tax residency status. This can be achieved by obtaining a Tax Identification Number (TIN) from the IRS.

Brokerage Accounts: Non-US citizens must open a brokerage account with a US-based brokerage firm. It's essential to choose a reputable firm that caters to international clients.

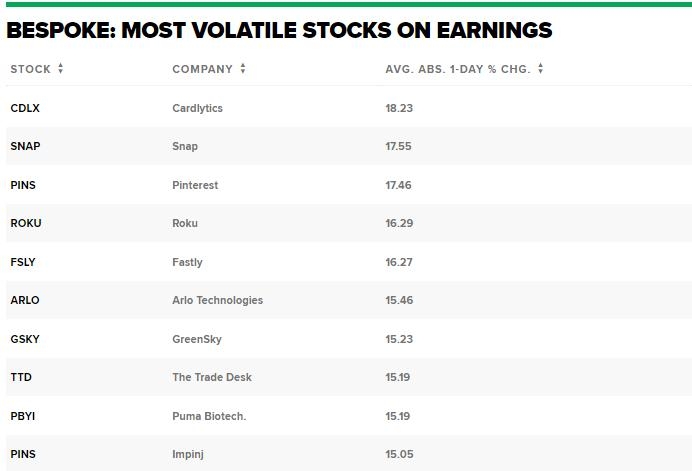

Understanding the Risks: While trading stocks can be lucrative, it's crucial to understand the risks involved. As with any investment, the stock market is subject to volatility and can lead to significant financial losses.

Choosing a Brokerage Firm

Selecting the right brokerage firm is essential for a smooth and successful trading experience. Here are some key factors to consider when choosing a brokerage firm for non-US citizens:

Regulatory Compliance: Ensure that the brokerage firm is registered with the appropriate regulatory bodies, such as the SEC and FINRA.

Customer Support: Look for a brokerage firm that offers excellent customer support, including multilingual support if needed.

Fee Structure: Understand the fee structure of the brokerage firm, including trading fees, account maintenance fees, and any other charges.

Platform Features: Consider the platform features offered by the brokerage firm, such as research tools, charting software, and mobile trading capabilities.

Top Brokers for Non-US Citizens

Several brokerage firms have a proven track record of serving non-US citizens effectively. Some of the top options include:

E*TRADE: E*TRADE offers a user-friendly platform and comprehensive research tools, making it an excellent choice for non-US citizens.

Fidelity: Fidelity provides a wide range of investment options and a strong focus on customer service.

Charles Schwab: Charles Schwab offers competitive fees and an extensive selection of investment products.

Case Study: John from Germany

John, a German citizen, decided to invest in the US stock market. After researching various brokerage firms, he chose E*TRADE due to its user-friendly platform and excellent customer support. John successfully opened a brokerage account, funded it, and started trading stocks. Over time, he developed a solid understanding of the market and achieved impressive returns on his investments.

In conclusion, non-US citizens can trade stocks in the US, but it's essential to understand the legal requirements and choose the right brokerage firm. By doing so, you can invest in the American stock market and potentially achieve significant financial gains.

us stock market live