Can I Buy US Stocks from Russia?

author:US stockS -

In today's interconnected world, the allure of investing in US stocks from abroad is increasingly appealing. For individuals in Russia, the question of whether they can purchase US stocks has become a pivotal one. This article delves into the intricacies of investing in US stocks from Russia, offering insights and guidance to those contemplating this financial move.

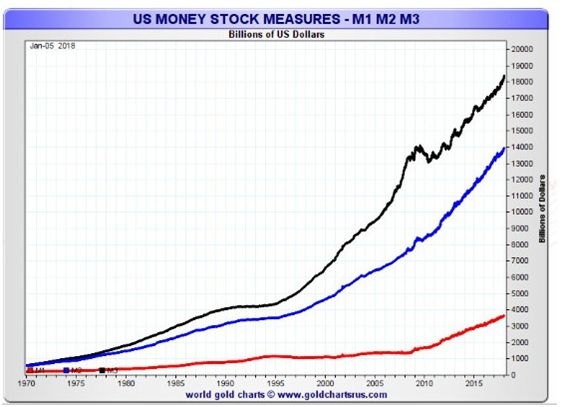

Understanding the Market

The US stock market is renowned for its diversity and liquidity, making it an attractive destination for international investors. The S&P 500, the Dow Jones Industrial Average, and the NASDAQ are some of the most popular indices that encapsulate the performance of the US stock market. These indices include a mix of large-cap, mid-cap, and small-cap companies across various sectors, providing investors with a wide array of investment opportunities.

Legal Considerations

Before delving into the specifics of purchasing US stocks from Russia, it is crucial to understand the legal framework. While there are no explicit restrictions on Russian investors purchasing US stocks, there are certain regulations and compliance requirements to consider.

Brokerage Accounts and Online Platforms

One of the primary methods for Russian investors to buy US stocks is through brokerage accounts. Several reputable online brokerage platforms, such as TD Ameritrade, E*TRADE, and Charles Schwab, offer services tailored to international investors. These platforms provide a user-friendly interface, competitive fees, and access to a wide range of investment tools.

Currency Conversion and Fees

When purchasing US stocks from Russia, it is essential to consider currency conversion and associated fees. Most online brokerage platforms offer currency conversion services, but these services may come with additional costs. It is advisable to compare the fees and conversion rates offered by different platforms to ensure the most cost-effective option.

Tax Implications

Taxation is another critical aspect to consider when investing in US stocks from Russia. Russian investors are subject to Russian tax laws, which may require reporting and paying taxes on any investment income earned from US stocks. Additionally, US tax laws may apply, especially if the investor holds US stocks for an extended period. It is advisable to consult with a tax professional to understand the specific tax implications and ensure compliance with both Russian and US tax regulations.

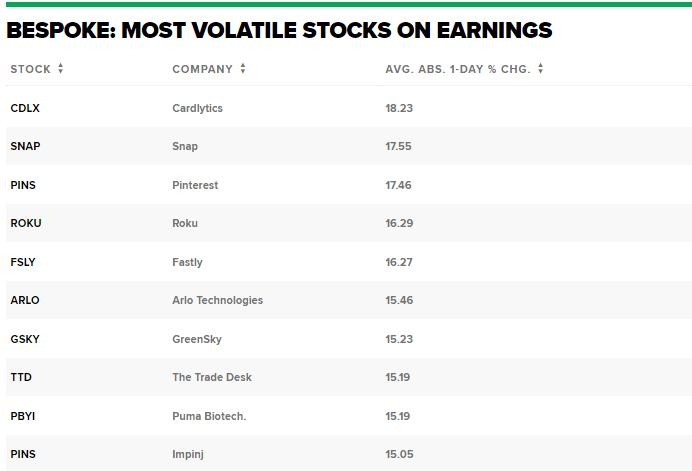

Case Study: Investing in US Tech Stocks

A prime example of a successful investment in US stocks from Russia is the case of a Russian investor who purchased shares of a leading US tech company. By leveraging a reputable online brokerage platform, the investor was able to gain exposure to the US tech sector and benefit from the company's strong performance. This case highlights the potential for significant returns when investing in US stocks, especially in sectors like technology, which are often at the forefront of innovation.

Conclusion

In conclusion, Russian investors can indeed purchase US stocks, provided they navigate the legal, regulatory, and financial complexities involved. By selecting the right brokerage platform, understanding currency conversion and fees, and being aware of tax implications, Russian investors can successfully invest in the US stock market. While investing in US stocks carries its own set of risks, the potential for significant returns makes it a compelling option for international investors.

us stock market live