Can I Buy Huawei Stock in the US?

author:US stockS -

Are you intrigued by the potential of Huawei, the Chinese tech giant, and considering investing in its stock from the United States? This article delves into the feasibility of purchasing Huawei stock in the US, exploring the current landscape and potential implications.

Understanding Huawei's Presence in the US

Huawei, a leading global provider of information and communications technology (ICT) infrastructure and smart devices, has long been a subject of interest for investors. However, the company's presence in the US has been somewhat complex due to various trade restrictions and political tensions.

Purchasing Huawei Stock: The Legal Landscape

As of now, it is possible to purchase Huawei stock in the US, but there are important considerations to keep in mind. In 2019, the US Department of Commerce placed Huawei on its Entity List, which restricts American companies from selling critical technology to Huawei without government approval. This action has had a significant impact on Huawei's ability to operate in the US market.

Despite these restrictions, Huawei stock is still available for purchase through certain platforms. Investors can buy shares of Huawei through international exchanges, such as the Hong Kong Stock Exchange (HKEX), where the company is listed under the ticker "002502.HK." However, this requires a brokerage account that supports international trading and a thorough understanding of the associated risks.

Risks and Considerations

Before investing in Huawei stock, it is crucial to understand the following risks and considerations:

Political and Regulatory Risks: The relationship between the US and China is often tense, and any changes in the political landscape could impact Huawei's operations and stock price.

Technology Restrictions: The Entity List restrictions may limit Huawei's ability to develop and innovate, potentially affecting its long-term growth prospects.

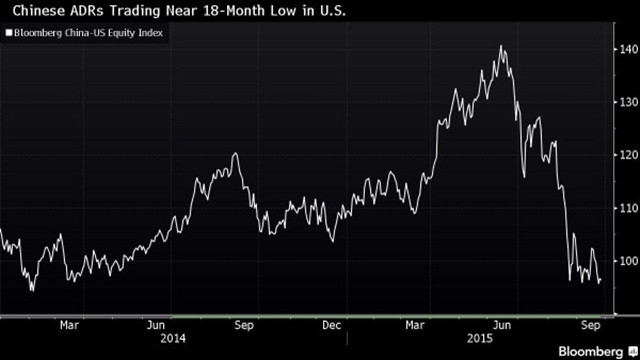

Market Volatility: Huawei's stock, like any other, is subject to market volatility. It is essential to conduct thorough research and consider your risk tolerance before investing.

Case Study: The Impact of Trade Restrictions on Huawei

A prime example of the impact of trade restrictions on Huawei is the company's struggle to secure components for its smartphones. In 2019, Google announced it would stop providing Android updates to Huawei's new smartphones, which were already affected by the Entity List restrictions. This decision forced Huawei to develop its own operating system, HarmonyOS, which is still in its early stages.

Despite these challenges, Huawei remains a dominant player in the global tech industry, with a strong presence in markets outside of the US. Its ability to adapt and innovate in the face of adversity is a testament to its resilience.

Conclusion

While it is possible to purchase Huawei stock in the US, it is essential to weigh the risks and consider the company's current and future challenges. As with any investment, thorough research and a clear understanding of the market landscape are crucial.

us stock market live