Can ADRs Be Traded on the US Stock Exchange?

author:US stockS -

Investors looking to diversify their portfolios often consider American Depositary Receipts (ADRs) as an excellent way to gain exposure to foreign stocks without directly dealing with the complexities of international markets. But one crucial question often arises: Can ADRs be traded on the US stock exchange? In this article, we delve into the intricacies of ADRs, their benefits, and their trading potential on the US stock exchange.

What Are ADRs?

Firstly, it's essential to understand what ADRs are. An ADR is a security representing a number of shares in a foreign company that is traded on a US stock exchange. It's essentially a US dollar-denominated stock certificate issued by a bank on behalf of a foreign company. By purchasing an ADR, investors can buy shares of a foreign company without the need to go through the process of purchasing and holding the actual stock in the foreign country.

Benefits of Trading ADRs on the US Stock Exchange

There are several reasons why trading ADRs on the US stock exchange is advantageous:

- Ease of Trading: Trading ADRs is straightforward, as they are listed on major US stock exchanges like the New York Stock Exchange (NYSE) and the NASDAQ. This means investors can buy and sell ADRs using the same platforms they use for US stocks.

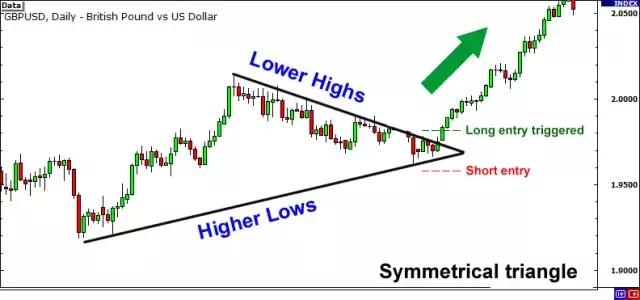

- Liquidity: ADRs tend to be more liquid than the actual shares of foreign companies. This is because ADRs are typically more widely traded, offering investors better price discovery and the ability to enter and exit positions quickly.

- Transparency: ADRs are subject to the same regulatory requirements as US stocks, including reporting and disclosure. This provides investors with a higher level of transparency and accountability compared to some foreign markets.

- Tax Advantages: ADRs may offer tax advantages, as investors can often avoid paying capital gains tax on dividends until they sell the shares.

Trading ADRs on the US Stock Exchange

So, can ADRs be traded on the US stock exchange? The answer is a resounding yes. ADRs are readily available for trading on the NYSE and NASDAQ, among other exchanges. To trade ADRs, investors simply need to open a brokerage account and follow the same process as they would for trading US stocks.

Case Studies: Successful ADR Trading

Several companies have successfully leveraged ADRs to gain access to the US market. One notable example is Baidu, the Chinese search engine giant. By listing its ADRs on the NASDAQ, Baidu was able to tap into the US capital markets and attract a significant number of investors. Another example is Tencent Holdings, which also listed its ADRs on the NYSE, providing US investors with access to the world's largest gaming company.

In conclusion, ADRs offer a compelling way for investors to gain exposure to foreign stocks while enjoying the benefits of trading on the US stock exchange. With their ease of trading, liquidity, and transparency, ADRs have become an essential tool for investors seeking global diversification.

us stock market live