CNBC US Stock Movers: The Latest Trends and Insights

author:US stockS -

In the fast-paced world of the stock market, staying informed about the latest trends and movements is crucial for investors. CNBC US Stock Movers provides a comprehensive overview of the most significant stock movements, offering valuable insights into market dynamics. This article delves into the latest trends and examines key factors driving stock movements, providing investors with the knowledge to make informed decisions.

Understanding Stock Movements

Stock movements can be influenced by a variety of factors, including economic indicators, corporate earnings reports, and geopolitical events. By analyzing these factors, investors can gain a better understanding of the reasons behind stock movements and make more informed investment decisions.

Top Movers: A Closer Look

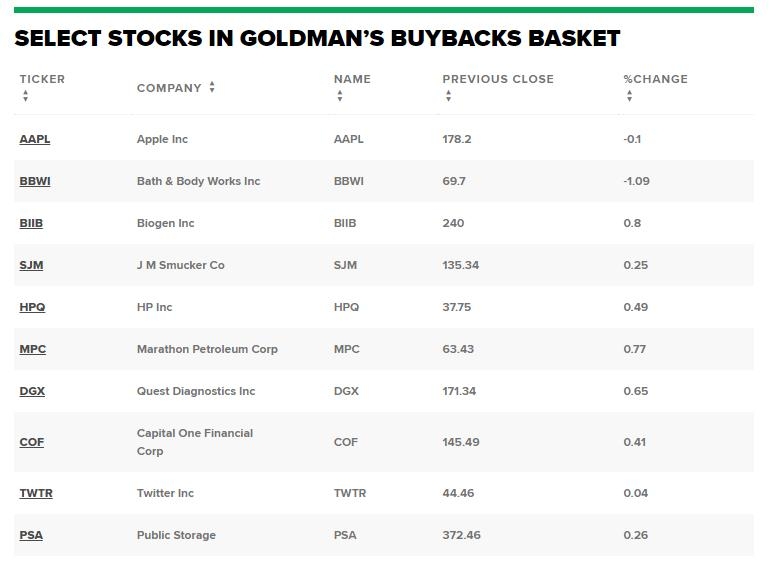

Technology Stocks - The technology sector has been a major driver of stock movements in recent years. Companies like Apple, Microsoft, and Amazon have seen significant growth, driven by strong earnings reports and increasing demand for their products and services. As the world becomes more digital, technology stocks are likely to remain a key area of focus for investors.

Energy Stocks - The energy sector has experienced a surge in recent months, thanks to rising oil prices and increased demand for energy resources. Companies like ExxonMobil and Chevron have seen their stock prices rise as a result. However, investors should be cautious, as energy prices can be volatile and subject to geopolitical risks.

Healthcare Stocks - The healthcare sector has been a stable performer, with companies like Johnson & Johnson and Pfizer seeing steady growth. The aging population and increasing demand for healthcare services have contributed to the sector's strong performance. Additionally, advancements in medical technology and pharmaceuticals have further boosted investor confidence.

Factors Influencing Stock Movements

Economic Indicators - Economic indicators such as GDP growth, unemployment rates, and inflation can have a significant impact on stock movements. Positive economic indicators can lead to increased investor confidence and higher stock prices, while negative indicators can have the opposite effect.

Corporate Earnings Reports - Companies' earnings reports provide valuable insights into their financial performance and future prospects. Strong earnings reports can drive stock prices higher, while weak reports can lead to declines.

Geopolitical Events - Geopolitical events, such as trade wars or political instability, can have a significant impact on stock movements. These events can create uncertainty in the market, leading to volatility and rapid stock movements.

Case Study: Tesla's Stock Surge

One notable example of a stock surge is that of Tesla, Inc. The electric vehicle manufacturer has seen its stock price skyrocket in recent years, driven by strong sales and innovative technology. Tesla's success has been attributed to several factors, including its commitment to sustainable energy and advancements in battery technology. As the world moves towards electric vehicles, Tesla's stock is likely to remain a key area of focus for investors.

Conclusion

Staying informed about the latest stock movements is essential for investors looking to make informed decisions. By understanding the factors driving stock movements and analyzing key sectors, investors can better navigate the complex world of the stock market. CNBC US Stock Movers provides a valuable resource for investors seeking to stay ahead of the curve and capitalize on market trends.

us stock market live