2026 US Stock Market Forecast: What to Expect?

author:US stockS -

The stock market is a dynamic and ever-evolving landscape, with predictions and forecasts shaping investors' strategies. As we approach 2026, many are eager to know what the future holds for the US stock market. In this article, we will delve into the latest forecasts and insights to help you make informed decisions.

Understanding the Current Landscape

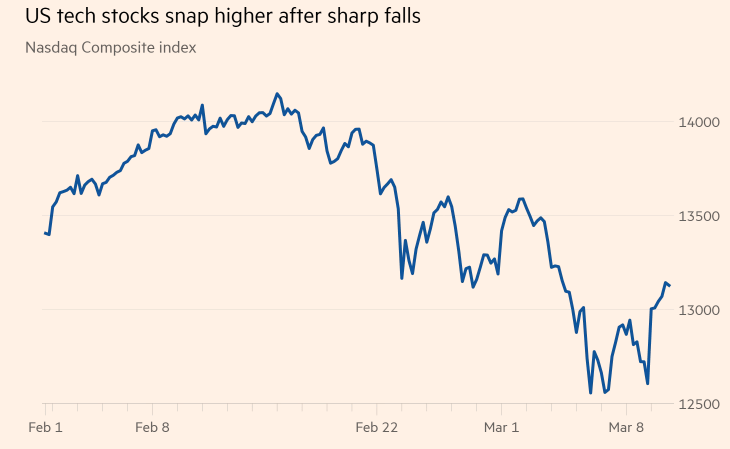

To predict the stock market in 2026, it is crucial to first understand the current market trends. As of early 2023, the US stock market has seen significant fluctuations, with tech stocks leading the charge and value stocks struggling to keep pace.

Tech Stocks: The New Market Drivers

Technology stocks have been a major driving force in the US stock market. Companies like Apple, Amazon, and Google have seen their market capitalization soar, attracting investors seeking high growth potential. With advancements in artificial intelligence, 5G technology, and cloud computing, tech stocks are expected to continue their upward trajectory.

Value Stocks: A Comeback in the Making?

On the other hand, value stocks have been underperforming for several years. However, some experts believe that a shift is on the horizon. As interest rates rise and economic uncertainty looms, value stocks could see a comeback, offering a more stable investment option for risk-averse investors.

2026 Stock Market Forecast: Key Factors to Consider

Several factors will play a crucial role in shaping the US stock market in 2026. Here are some of the key factors to consider:

Economic Growth: Economic conditions, including GDP growth, inflation rates, and employment data, will be crucial in determining market trends. A robust economy is generally seen as a positive sign for the stock market.

Interest Rates: The Federal Reserve's monetary policy will continue to influence the stock market. Higher interest rates can lead to increased borrowing costs for companies, potentially dampening growth.

Geopolitical Events: The global political landscape, including trade disputes and geopolitical tensions, can impact investor sentiment and market stability.

Corporate Earnings: The profitability of companies will remain a key driver of stock prices. Companies with strong earnings and growth prospects are likely to see their stocks perform well.

Technological Advancements: The rapid pace of technological innovation will continue to shape the stock market, with companies at the forefront of emerging technologies likely to outperform.

Case Studies: Past Market Predictions and Lessons Learned

To better understand the potential direction of the stock market in 2026, let's look at some past market predictions and the lessons learned:

2008 Financial Crisis: The 2008 financial crisis served as a stark reminder of the volatility and unpredictability of the stock market. Despite the market's recovery, investors should remain cautious and diversified.

Dot-com Bubble: The dot-com bubble in the late 1990s highlighted the importance of thorough research and due diligence before investing in high-flying tech stocks. Companies with solid business models and sustainable growth potential are more likely to weather market downturns.

2020 Pandemic-Induced Downturn: The COVID-19 pandemic caused a significant downturn in the stock market, but it also provided opportunities for long-term investors. Companies with strong fundamentals and adaptability to remote work and online sales saw their stocks surge.

Conclusion: Navigating the Stock Market in 2026

As we approach 2026, the US stock market will likely face various challenges and opportunities. By understanding the current landscape, key factors, and lessons learned from past market predictions, investors can better navigate the market and make informed decisions. Remember, the stock market is dynamic, and staying informed and adaptable is crucial to long-term success.

us stock market live