2018 US Stock Market Outlook: A Comprehensive Analysis

author:US stockS -

As we approach the end of 2017, investors are eagerly eyeing the 2018 US stock market outlook. With the Federal Reserve's interest rate hikes, the rise of the Trump administration, and a host of global uncertainties, the market's trajectory in 2018 is anything but predictable. This article aims to provide a comprehensive analysis of the key factors that could influence the US stock market in the coming year.

Economic Growth and Interest Rates

The primary driver of the stock market is economic growth. In 2018, the US economy is expected to continue expanding, driven by factors such as low unemployment, strong consumer spending, and a healthy housing market. However, the Federal Reserve's decision to raise interest rates in 2018 could pose a challenge.

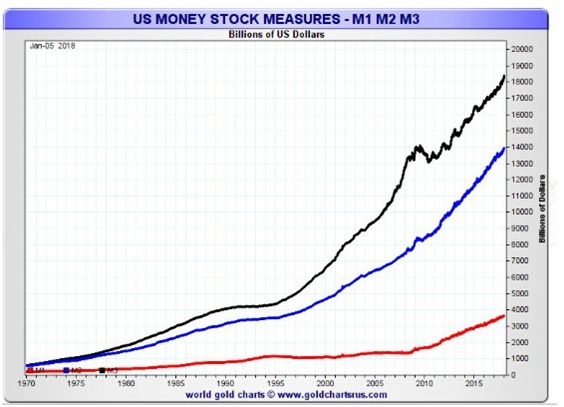

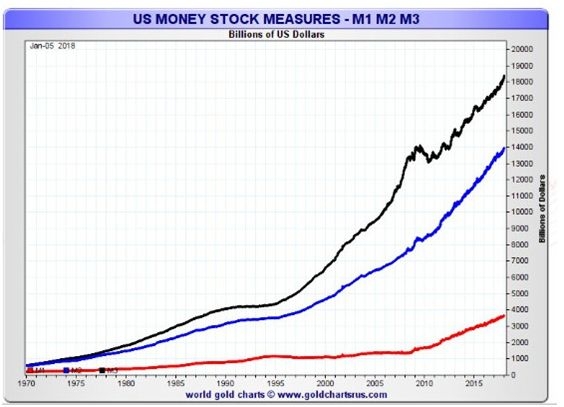

The Fed's Interest Rate Hike

The Federal Reserve has signaled its intent to raise interest rates three times in 2018. While this is expected to have a modest impact on the stock market, it could lead to higher borrowing costs for corporations and consumers, potentially slowing economic growth. However, many analysts believe that the positive economic fundamentals will outweigh the negative effects of higher interest rates.

Corporate Earnings

Another crucial factor in the 2018 US stock market outlook is corporate earnings. Companies have been reporting strong earnings in recent quarters, and this trend is expected to continue in 2018. The rise of technology and e-commerce has been a significant contributor to this growth, with companies like Amazon and Apple leading the way.

Tax Reform

The Trump administration's tax reform package, which was passed in December 2017, is expected to have a significant impact on the US stock market in 2018. The reduction in corporate tax rates is expected to boost corporate earnings and potentially lead to increased investment and job creation.

Global Uncertainties

While the US economy is expected to remain strong in 2018, global uncertainties could pose a threat to the stock market. Factors such as trade tensions between the US and China, political instability in Europe, and the ongoing Brexit negotiations could lead to volatility in the market.

Sector Analysis

Technology: The technology sector has been a major driver of the stock market's growth in recent years. Companies like Apple, Microsoft, and Google continue to dominate the market, and this trend is expected to continue in 2018.

Energy: The energy sector has seen a significant turnaround in recent years, driven by the rise of shale oil and gas production. As the US becomes more energy-independent, the energy sector could see continued growth in 2018.

Healthcare: The healthcare sector is another area to watch in 2018. With the implementation of the Affordable Care Act and the rise of telemedicine, the healthcare sector could see significant growth in the coming years.

Conclusion

The 2018 US stock market outlook is complex and uncertain. While economic growth and corporate earnings are expected to remain strong, global uncertainties and interest rate hikes could pose challenges. Investors should carefully consider these factors when making investment decisions in 2018.

Key Takeaways:

- The US economy is expected to continue expanding in 2018.

- The Federal Reserve's interest rate hikes could impact the market.

- Corporate earnings are expected to remain strong.

- Tax reform could boost corporate earnings and investment.

- Global uncertainties could lead to market volatility.

- Technology, energy, and healthcare sectors are key areas to watch.

us stock market live