Upcoming US Stock Splits: What Investors Need to Know

author:US stockS -

As the stock market continues to evolve, investors are always on the lookout for opportunities to maximize their returns. One such opportunity that often goes unnoticed is the upcoming stock splits. In this article, we'll delve into what stock splits are, why companies initiate them, and how they can impact your investments.

What is a Stock Split?

A stock split is a corporate action where a company divides its existing shares into multiple shares. For example, a 2-for-1 stock split means that for every share you own, you will receive an additional share. The purpose of a stock split is to make the shares more accessible to a broader range of investors, as lower-priced shares can attract more buyers.

Why Do Companies Initiate Stock Splits?

There are several reasons why a company might choose to split its stock:

- Increase Liquidity: Lower-priced shares can make it easier for investors to buy and sell the stock, thereby increasing liquidity.

- Enhance Marketability: A more affordable share price can make the stock more attractive to new investors, potentially boosting the company's market capitalization.

- Improve Perception: Some investors view lower-priced shares as more attainable and may perceive the company as more valuable.

- Historical Practice: Many companies have a long-standing tradition of splitting their stock to maintain its relevance in the market.

Impact on Investors

While stock splits don't directly affect the company's value, they can have several indirect impacts on investors:

- Share Price: After a stock split, the share price will typically fall, reflecting the increased number of shares outstanding. However, the market capitalization (total value of the company) remains the same.

- Dividends: Dividends per share may be adjusted to reflect the stock split, but the total dividend amount paid by the company remains unchanged.

- Investment Strategy: Some investors use stock splits as a signal to reassess their investment strategy. For instance, a split might prompt an investor to reevaluate the company's growth prospects or market position.

Upcoming Stock Splits in the US

Several companies are expected to announce stock splits in the near future. Here are a few notable examples:

- Apple Inc. (AAPL): Apple is rumored to be considering a 4-for-1 stock split, which would reduce the share price and potentially increase liquidity.

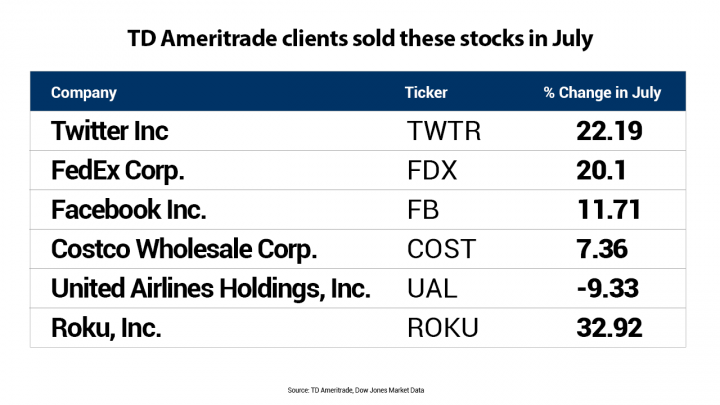

- Facebook Inc. (FB): Facebook's parent company, Meta Platforms, has previously announced a stock split, and investors are eagerly awaiting the outcome.

- Amazon.com Inc. (AMZN): Amazon has not announced any stock splits in recent years, but speculation is ongoing regarding a potential future split.

Case Study: Alphabet Inc. (GOOGL)

In 2020, Alphabet Inc., the parent company of Google, announced a 20-for-1 stock split. The move was aimed at making the shares more accessible to a wider range of investors. Following the split, the share price dropped significantly, but the market capitalization remained the same. Investors who held onto their shares saw the value of their investments increase, as the company continued to grow and perform well.

In conclusion, upcoming stock splits in the US can offer valuable opportunities for investors. By understanding the implications of these splits and keeping an eye on companies that are rumored to announce them, investors can stay ahead of the curve and potentially capitalize on market movements.

new york stock exchange