Understanding the US Stock Exchange Rate: A Comprehensive Guide

author:US stockS -

The US stock exchange rate refers to the value of one currency (typically the US dollar) in relation to another. For investors and traders, this rate plays a crucial role in determining the cost and potential returns of investments. In this comprehensive guide, we'll delve into what the US stock exchange rate is, how it affects the market, and provide practical insights for investors.

What is the US Stock Exchange Rate?

The US stock exchange rate is the value of the US dollar compared to other currencies. This rate fluctuates constantly due to various economic factors, such as interest rates, inflation, and geopolitical events. It's essential for investors to understand this rate because it can significantly impact their investments, particularly when dealing with international stocks.

How Does the US Stock Exchange Rate Affect the Market?

Impact on Stock Prices: When the US dollar strengthens, it makes US stocks more expensive for foreign investors. Conversely, when the US dollar weakens, foreign investors can buy more US stocks with their local currency. This can lead to increased demand for US stocks and potentially drive up their prices.

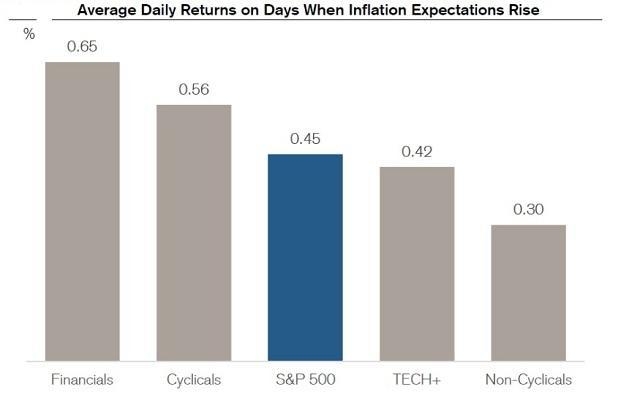

Inflation and Interest Rates: The US stock exchange rate is closely tied to inflation and interest rates. If the US experiences higher inflation or higher interest rates, the value of the US dollar may decrease. This can make US stocks more attractive to foreign investors, as they can buy them at a lower price.

Geopolitical Events: Geopolitical events, such as political instability or trade wars, can also impact the US stock exchange rate. These events can lead to volatility in the market and affect investor sentiment.

Key Factors Influencing the US Stock Exchange Rate

Economic Data: Economic data, such as GDP growth, unemployment rates, and inflation rates, can influence the US stock exchange rate. Strong economic data can lead to a stronger US dollar, while weak data can weaken it.

Interest Rates: The Federal Reserve's monetary policy, including interest rate decisions, can significantly impact the US stock exchange rate. Higher interest rates can strengthen the US dollar, while lower interest rates can weaken it.

Geopolitical Events: As mentioned earlier, geopolitical events can also influence the US stock exchange rate.

Case Study: Impact of the US Stock Exchange Rate on International Investors

Consider an investor from Japan who wants to invest in US stocks. If the US dollar strengthens against the Japanese yen, the investor will need to spend more yen to purchase US stocks. Conversely, if the US dollar weakens, the investor will need to spend fewer yen, making US stocks more affordable.

Conclusion

Understanding the US stock exchange rate is crucial for investors, especially those dealing with international stocks. By keeping an eye on economic data, interest rates, and geopolitical events, investors can make more informed decisions and potentially maximize their returns. Whether you're a seasoned investor or just starting out, knowing how the US stock exchange rate works can give you a competitive edge in the market.

new york stock exchange