Understanding iShares US Preferred Stock Dividend: A Comprehensive Guide

author:US stockS -

Are you looking to invest in preferred stocks but are unsure about the iShares US Preferred Stock Dividend? This guide will provide you with an in-depth understanding of this investment option, including its benefits, risks, and potential returns. By the end of this article, you'll be equipped with the knowledge to make an informed decision about investing in iShares US Preferred Stock Dividend.

What is iShares US Preferred Stock Dividend?

iShares US Preferred Stock Dividend is an exchange-traded fund (ETF) that tracks the performance of a basket of U.S.-listed preferred stocks. These preferred stocks are issued by corporations and offer fixed dividends to investors. Unlike common stocks, preferred stocks have a higher claim on the company's assets and earnings, making them a more stable investment option.

Benefits of Investing in iShares US Preferred Stock Dividend

Stable Dividends: Preferred stocks offer fixed dividends, which can provide a consistent income stream for investors. The iShares US Preferred Stock Dividend ETF tracks these dividends, ensuring investors receive regular payouts.

Income Tax Advantages: Dividends from preferred stocks are typically taxed at a lower rate than ordinary income. This can result in significant tax savings for investors.

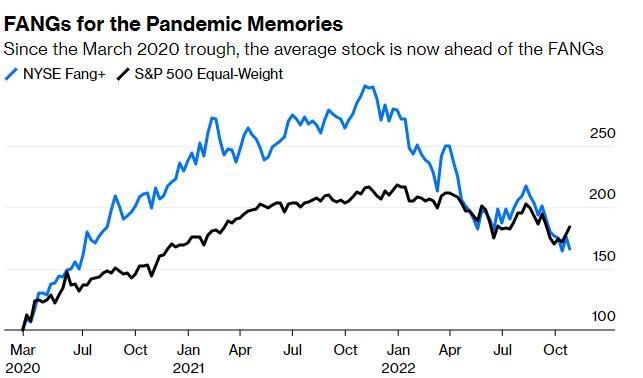

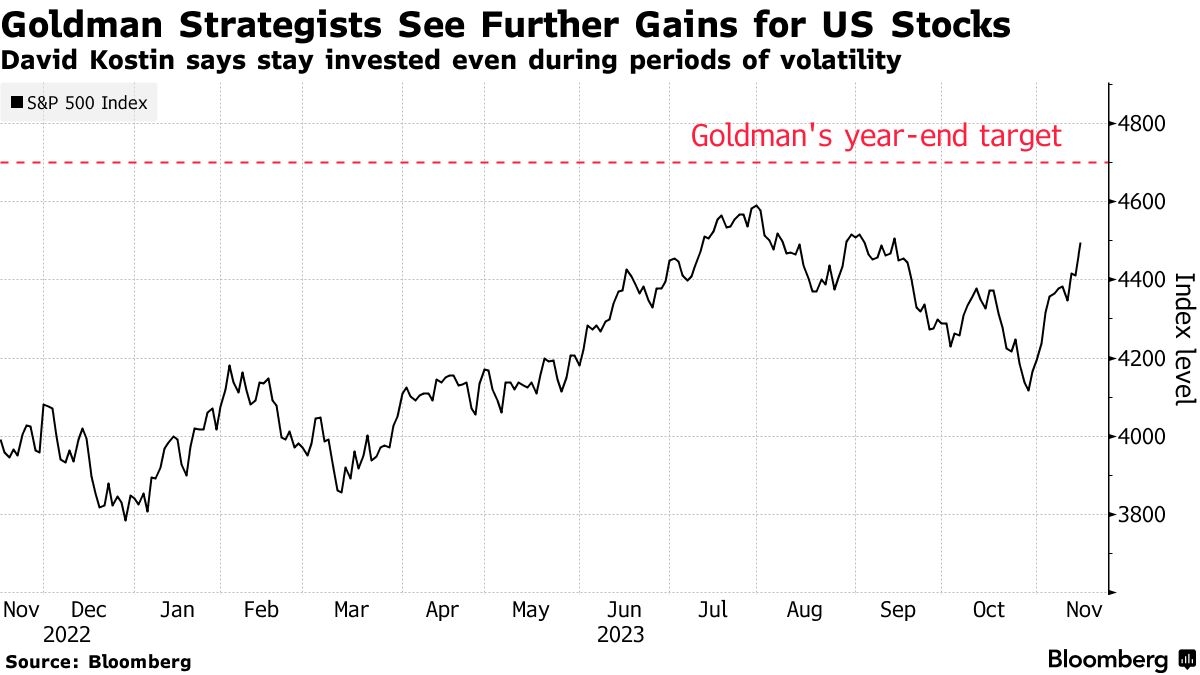

Capital Appreciation: While preferred stocks are known for their stable dividends, some can also appreciate in value over time. The iShares US Preferred Stock Dividend ETF provides exposure to this potential capital appreciation.

Diversification: The iShares US Preferred Stock Dividend ETF tracks a basket of preferred stocks, offering diversification and reducing the risk associated with investing in a single stock.

Risks of Investing in iShares US Preferred Stock Dividend

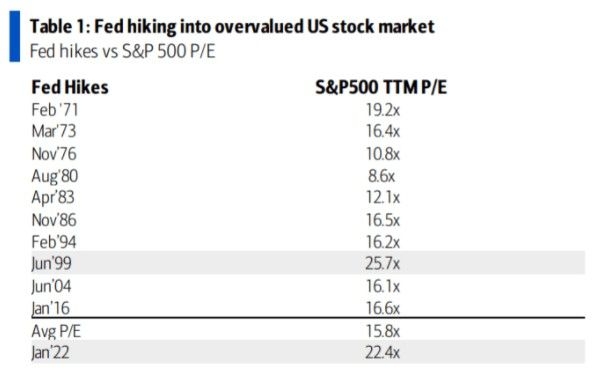

Credit Risk: Preferred stocks are riskier than bonds but less risky than common stocks. The risk of default is higher if the issuing company faces financial difficulties.

Liquidity Risk: While preferred stocks are generally more liquid than bonds, some may be less liquid, particularly if the issuing company is small or struggling.

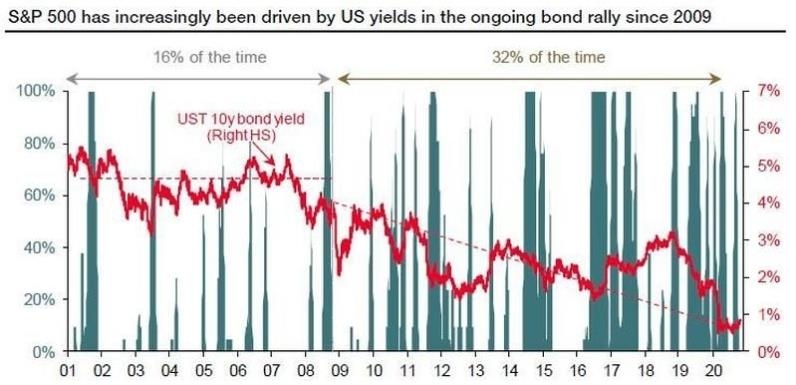

Interest Rate Risk: Preferred stocks tend to be more sensitive to changes in interest rates. If interest rates rise, the value of preferred stocks may decline.

How to Invest in iShares US Preferred Stock Dividend

Investing in iShares US Preferred Stock Dividend is straightforward. You can purchase shares of the ETF through a brokerage account. Here's how:

Open a Brokerage Account: If you don't already have a brokerage account, you'll need to open one. Many online brokers offer free accounts and low fees.

Fund Your Account: Transfer funds to your brokerage account to purchase shares of the iShares US Preferred Stock Dividend ETF.

Purchase Shares: Use your brokerage account to buy shares of the ETF. You can purchase shares online or through a mobile app.

Monitor Your Investment: Keep an eye on the performance of the ETF and your investment to ensure it aligns with your financial goals.

Case Study: iShares US Preferred Stock Dividend

Let's consider an example of an investor who invested

In conclusion, investing in iShares US Preferred Stock Dividend can be a wise decision for investors seeking stable dividends and potential capital appreciation. However, it's important to understand the risks associated with preferred stocks and to invest according to your financial goals and risk tolerance.

new york stock exchange