Understanding Maryland US Obligations, Tax, and Stock

author:US stockS -

In the bustling financial landscape of the United States, Maryland stands out as a state with unique obligations, tax regulations, and stock market dynamics. For investors, businesses, and residents alike, understanding these elements is crucial for making informed decisions. This article delves into the intricacies of Maryland’s obligations, tax policies, and stock market, providing a comprehensive guide for those navigating the state’s financial terrain.

Understanding Maryland Obligations

Maryland, like any other state, has its own set of obligations. These obligations encompass a range of responsibilities, from state-funded projects to public services. Understanding these obligations is vital for anyone involved in Maryland’s financial ecosystem.

Tax Obligations in Maryland

One of the most critical aspects of Maryland obligations is its tax system. Maryland has a complex tax structure, which includes state income tax, sales tax, and property tax. Here’s a breakdown of the key tax obligations in Maryland:

- State Income Tax: Maryland has a progressive state income tax system, with rates ranging from 2% to 6.25%. This means that the higher your income, the higher your tax rate.

- Sales Tax: Maryland’s sales tax rate is 6%, with additional local taxes varying by jurisdiction.

- Property Tax: Property tax in Maryland is levied on real estate and personal property. The rates vary depending on the county and local government.

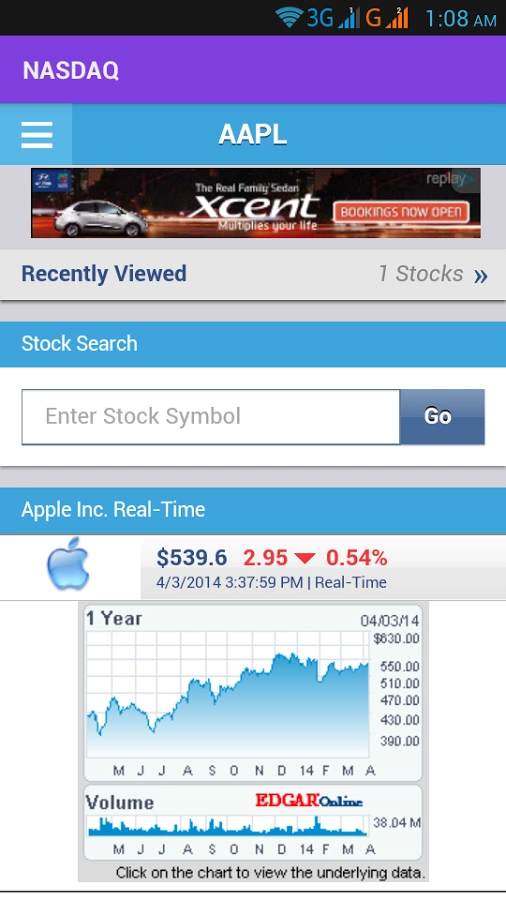

Navigating Maryland Stock Market Dynamics

The stock market is a key component of Maryland’s financial landscape. Understanding the dynamics of the Maryland stock market is crucial for investors looking to capitalize on the state’s economic growth.

Key Factors Influencing Maryland Stock Market

Several factors influence the Maryland stock market:

- Economic Growth: Maryland’s robust economy, driven by sectors like technology, healthcare, and education, has a positive impact on the stock market.

- Corporate Tax Policies: Maryland’s tax policies, particularly those affecting corporations, can significantly impact the stock market.

- Investor Sentiment: The sentiment of investors towards Maryland-based companies can also influence the stock market.

Case Study: Maryland-Based Companies

To illustrate the impact of Maryland obligations, tax policies, and the stock market, let’s look at a case study involving a Maryland-based company.

Company XYZ

Company XYZ, a technology firm based in Maryland, has seen significant growth over the years. The company has benefited from Maryland’s favorable tax policies and the state’s thriving technology sector. As a result, its stock price has steadily increased, making it an attractive investment for many.

Conclusion

Understanding Maryland US obligations, tax, and stock market dynamics is essential for anyone looking to navigate the state’s financial landscape effectively. By staying informed about these factors, individuals and businesses can make informed decisions that align with their financial goals.

new york stock exchange