US Stocks Market Today: Key Trends and Analysis

author:US stockS -

In today's fast-paced world of finance, staying informed about the US stock market is crucial for investors and traders alike. As we delve into the US stocks market today, we'll explore the key trends, significant movements, and expert analysis that can impact your investment decisions.

Stock Market Overview:

The US stock market has experienced a volatile start to the year, with several factors contributing to the recent fluctuations. The ongoing trade tensions between the United States and China, along with economic uncertainties, have played a pivotal role in shaping market sentiment.

Key Trends:

Technology Stocks: Technology stocks have been a major driver of the US stock market's growth. Companies like Apple, Microsoft, and Amazon have seen significant gains, bolstering the overall market performance. However, it's essential to keep an eye on the regulatory landscape and potential antitrust issues that could impact these industry leaders.

Energy Sector: The energy sector has seen a remarkable turnaround, with crude oil prices stabilizing and natural gas demand rising. Companies like ExxonMobil and Chevron have reported strong earnings, reflecting the sector's recovery.

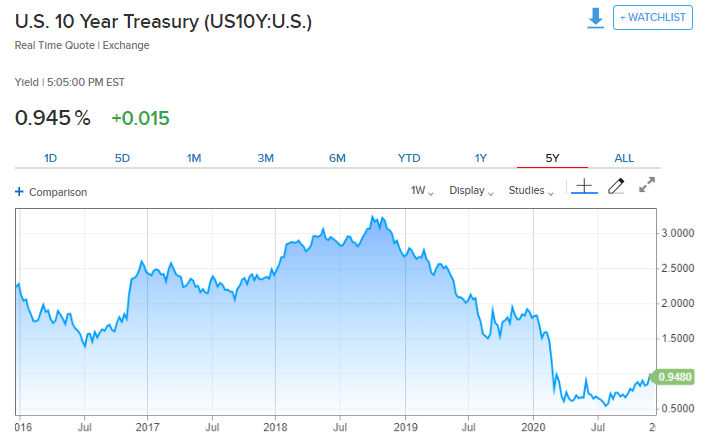

Financial Stocks: The financial sector has also experienced a positive outlook, driven by rising interest rates and strong earnings reports. Banks and insurance companies are expected to benefit from a favorable economic environment.

Significant Movements:

Dow Jones Industrial Average: The Dow Jones Industrial Average (DJIA) has been hovering around the 30,000 mark, reflecting a mix of optimism and uncertainty. The index's recent surge can be attributed to strong earnings reports and positive economic indicators.

S&P 500: The S&P 500 has also seen significant movement, with the index reaching an all-time high. However, concerns about inflation and the global economic outlook have led to some volatility in the market.

Nasdaq Composite: The Nasdaq Composite has experienced a notable increase, driven by strong performance in the technology sector. However, valuations remain a concern for some investors.

Expert Analysis:

According to financial experts, the US stock market is poised for a continued rebound, despite the recent volatility. Key factors contributing to this outlook include:

Economic Recovery: The US economy is gradually recovering from the COVID-19 pandemic, with consumer spending and business activity on the rise.

Monetary Policy: The Federal Reserve has signaled its commitment to maintaining accommodative monetary policy, which is expected to support market growth.

Corporate Earnings: Many companies are expected to report strong earnings, reflecting the resilience of the US economy.

Case Study:

A prime example of the US stock market's resilience is the tech giant Apple. Despite facing scrutiny over its business practices, Apple has continued to post strong earnings and see significant growth. This highlights the importance of diversifying your investment portfolio and focusing on companies with strong fundamentals.

In conclusion, the US stock market today presents a mix of opportunities and challenges. By staying informed about the key trends, significant movements, and expert analysis, investors and traders can make informed decisions and navigate the dynamic landscape of the market.

new york stock exchange