US Stock Buyback Chart: A Comprehensive Analysis

author:US stockS -

In recent years, stock buybacks have become a popular strategy among companies in the United States. This article delves into the concept of stock buybacks, their impact on company performance, and provides a comprehensive analysis of the US stock buyback chart.

What is a Stock Buyback?

A stock buyback, also known as a share repurchase, occurs when a company purchases its own shares from the open market. This process reduces the number of outstanding shares, which can increase the value of the remaining shares. Companies often engage in stock buybacks to boost shareholder value, return excess capital to investors, or signal confidence in their future prospects.

The Impact of Stock Buybacks

The impact of stock buybacks on a company's performance can be significant. When executed effectively, stock buybacks can lead to the following benefits:

- Increased Earnings Per Share (EPS): By reducing the number of outstanding shares, the company's EPS increases, which can positively impact the stock price.

- Enhanced Shareholder Value: Stock buybacks can increase the value of the remaining shares, benefiting current shareholders.

- Improved Financial Health: Companies with strong balance sheets may use stock buybacks to manage their capital structure and reduce debt levels.

However, it's important to note that stock buybacks can also have negative consequences if not managed properly. Over-reliance on stock buybacks can lead to a lack of investment in research and development, reduced future growth prospects, and potential overvaluation of the stock.

The US Stock Buyback Chart

To understand the trends and patterns in stock buybacks, we have compiled a comprehensive US stock buyback chart. This chart provides a visual representation of the number of shares repurchased by companies in the United States over the past decade.

Key Observations from the Chart:

- Overall Trend: The chart shows a steady increase in stock buybacks over the past decade, with a significant surge in 2020 due to the COVID-19 pandemic.

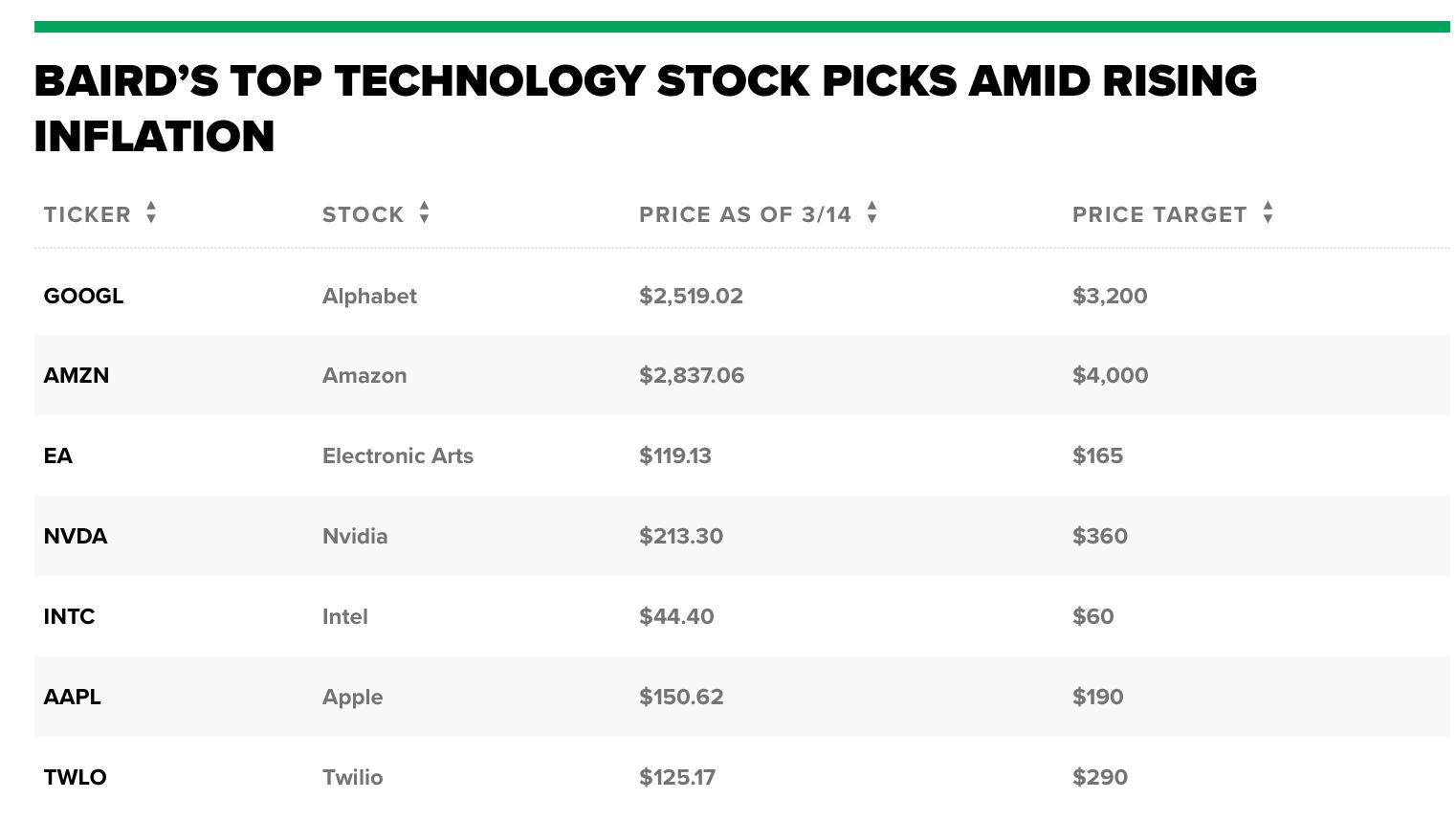

- Sector Variations: Certain sectors, such as technology and financial services, have seen a higher level of stock buybacks compared to others.

- Company Size: Larger companies tend to engage in more stock buybacks compared to smaller companies.

Case Studies:

To further illustrate the impact of stock buybacks, let's look at a couple of case studies:

- Apple Inc.: Apple has been a leading player in stock buybacks, repurchasing billions of dollars worth of shares over the years. This strategy has helped increase the company's EPS and shareholder value, making it one of the most valuable companies in the world.

- Microsoft Corporation: Similar to Apple, Microsoft has engaged in significant stock buybacks, which have contributed to its strong financial performance and growth.

Conclusion

Stock buybacks have become a crucial component of corporate finance in the United States. While they can provide numerous benefits, it's important for companies to manage stock buybacks effectively to ensure long-term success. The US stock buyback chart provides valuable insights into the trends and patterns in stock buybacks, helping investors and corporate executives make informed decisions.

new york stock exchange