US Retirement Funds Heavy on Stocks Brace for Losses

author:US stockS -

In the volatile financial markets, many American retirement funds are heavily invested in stocks, raising concerns about potential losses as the market faces uncertainty. This article delves into the reasons behind this heavy stock exposure and the risks associated with it.

The Stock-Heavy Approach

The primary reason behind the heavy investment in stocks by many retirement funds is the pursuit of higher returns. Historically, stocks have provided better returns than bonds and other fixed-income investments. This has led to a widespread belief that stocks are a safe bet for long-term growth.

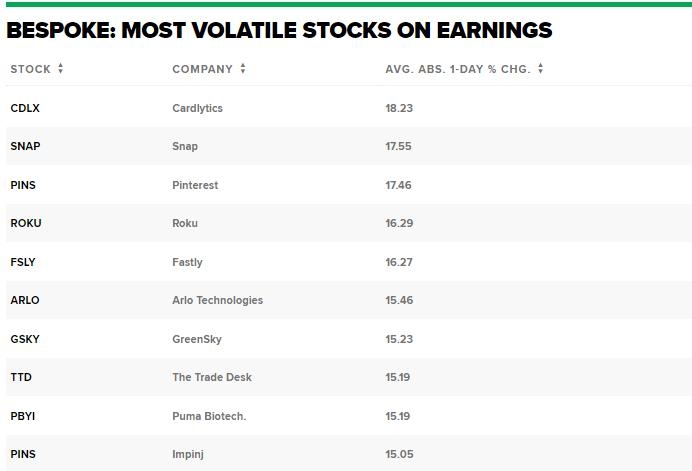

However, this approach comes with significant risks. Stock markets are inherently volatile, and their prices can fluctuate widely based on various economic and political factors. When the market experiences a downturn, retirement funds heavily invested in stocks can suffer substantial losses.

Risks of Market Downturns

Several factors contribute to the risks associated with stock-heavy retirement funds. One of the most significant risks is market volatility. Stock markets can experience sharp declines, often referred to as bear markets, which can lead to significant losses for investors.

Another risk is inflation. When inflation rises, the purchasing power of money decreases, and the value of stocks can decline. This can erode the purchasing power of retirement funds, making it challenging for retirees to maintain their standard of living.

Case Studies

Several recent events highlight the risks associated with stock-heavy retirement funds. For instance, the 2008 financial crisis resulted in significant losses for many retirement funds. Similarly, the COVID-19 pandemic caused a sharp downturn in the stock market, leading to substantial losses for investors.

One case study involves the California Public Employees' Retirement System (CalPERS), which had a significant portion of its assets invested in stocks. During the 2008 financial crisis, CalPERS experienced a loss of approximately $64 billion, significantly impacting its ability to meet its long-term obligations.

Mitigating Risks

To mitigate the risks associated with stock-heavy retirement funds, several strategies can be employed. One approach is to diversify the investment portfolio to include a mix of stocks, bonds, and other fixed-income investments. This can help reduce the risk of losses in a downturn.

Another strategy is to regularly review and adjust the investment portfolio to ensure it aligns with the individual's risk tolerance and retirement goals. This may involve reallocating assets from stocks to bonds or other investments to reduce exposure to market volatility.

Conclusion

In conclusion, retirement funds heavily invested in stocks face significant risks, particularly during market downturns. Understanding these risks and implementing strategies to mitigate them is crucial for ensuring the long-term financial security of retirees. As the stock market continues to face uncertainty, it is essential for retirement fund managers to carefully consider their investment strategies to protect the interests of their beneficiaries.

new york stock exchange