US Large Cap Value Stocks to Watch in 2025

author:US stockS -

In the ever-evolving world of financial markets, large cap value stocks have always been a cornerstone of investment portfolios. As we approach 2025, it's crucial to identify the top US large cap value stocks that are poised for significant growth. This article delves into the most promising stocks in this category and provides insights into their potential for the next decade.

Understanding Large Cap Value Stocks

Large cap value stocks are shares of companies with a market capitalization of over $10 billion that are trading at a discount to their intrinsic value. These companies are typically established, stable, and have a strong track record of profitability. Investors seeking long-term growth and income often find value in these stocks.

Top US Large Cap Value Stocks for 2025

Procter & Gamble (PG)

- Why It's a Winner: Procter & Gamble is a consumer goods giant with a diverse portfolio of brands. The company's strong financial health and commitment to innovation make it a compelling investment for value seekers.

- Case Study: Over the past five years, P&G has consistently returned value to shareholders through dividend increases and share repurchases.

Johnson & Johnson (JNJ)

- Why It's a Winner: Johnson & Johnson is a leader in the healthcare industry, with a diverse range of products and services. The company's robust pipeline of new drugs and commitment to sustainable practices make it a solid long-term investment.

- Case Study: JNJ has increased its dividend for 60 consecutive years, demonstrating its long-term commitment to value creation.

Coca-Cola Company (KO)

- Why It's a Winner: Coca-Cola is a global beverage giant with a strong brand and a loyal customer base. The company's focus on innovation and expansion into emerging markets makes it a compelling investment for long-term growth.

- Case Study: Over the past decade, KO has grown its revenue and earnings per share, providing strong returns for investors.

Exxon Mobil Corporation (XOM)

- Why It's a Winner: Exxon Mobil is one of the largest oil and gas companies in the world, with a strong presence in the energy sector. The company's commitment to diversification and exploration makes it a resilient investment.

- Case Study: XOM has paid consistent dividends for over 40 years, providing investors with a reliable source of income.

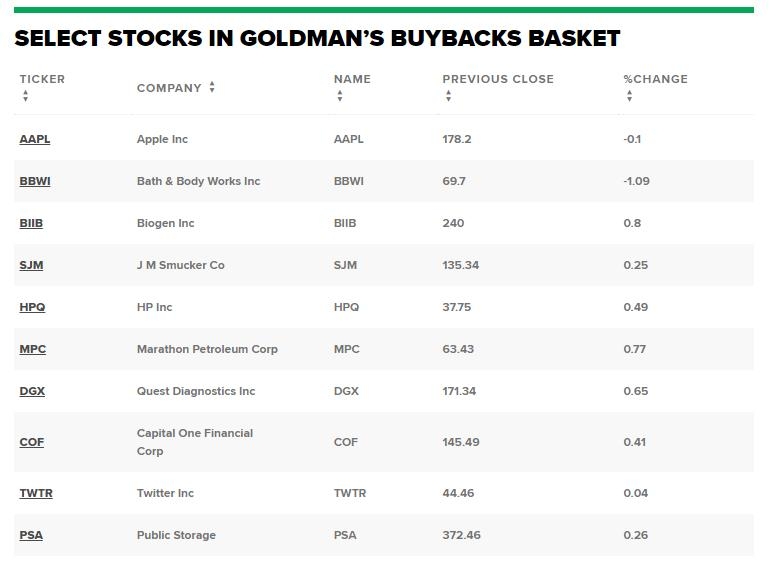

Apple Inc. (AAPL)

- Why It's a Winner: Apple is a technology giant with a strong brand and a loyal customer base. The company's commitment to innovation and its diverse product portfolio make it a compelling investment for long-term growth.

- Case Study: Over the past five years, AAPL has experienced significant growth in revenue and earnings per share, making it a top performer in the tech sector.

Conclusion

Investing in large cap value stocks can provide investors with long-term growth and income. As we approach 2025, the companies mentioned above are poised to deliver strong returns for investors who understand the value of these market leaders. By analyzing their financial health, commitment to innovation, and track record of profitability, investors can make informed decisions and build a diversified portfolio that stands the test of time.

new york stock exchange