US Election Stock Market: Impact and Opportunities

author:US stockS -

The US election stock market is a term that encapsulates the complex relationship between political events, particularly elections, and the performance of the stock market. As the United States gears up for its next presidential election, investors and analysts are closely watching how the stock market will respond. This article delves into the potential impacts and opportunities that the upcoming election might bring to the stock market.

Understanding the Dynamics

The stock market is influenced by a multitude of factors, including economic indicators, corporate earnings, and geopolitical events. However, political events, especially elections, can have a significant impact on investor sentiment and market performance. Historically, there has been a correlation between election years and stock market movements.

Historical Trends

One of the most notable trends in the US election stock market is the so-called "January effect." This refers to the tendency for the stock market to rise in the first month of the year, especially in election years. This trend can be attributed to a variety of factors, including tax refunds, increased consumer spending, and investor optimism about the new year.

The 2020 Election and the Stock Market

The 2020 US election was a particularly tumultuous one, with the stock market experiencing significant volatility. Despite the uncertainty, the market ended the year with gains, driven by factors such as the Federal Reserve's aggressive monetary policy and the rollout of COVID-19 vaccines.

Potential Impacts of the 2024 Election

The upcoming 2024 election is shaping up to be another closely contested one, with potential implications for the stock market. Here are some key factors to consider:

- Policy Changes: Different candidates may propose different economic policies, including tax reforms, regulatory changes, and trade policies. These policies can have a significant impact on various sectors of the economy and the stock market.

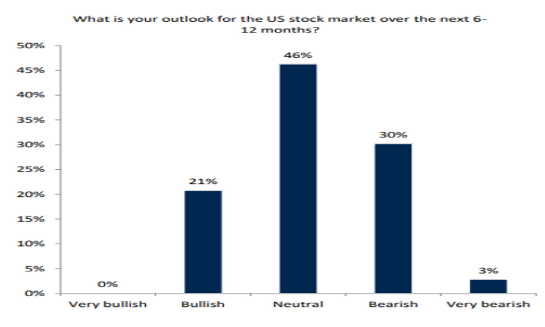

- Investor Sentiment: The outcome of the election can influence investor sentiment, leading to increased volatility in the stock market.

- Interest Rates: The Federal Reserve's stance on interest rates can be influenced by the election outcome, which in turn can affect borrowing costs and corporate profitability.

Opportunities for Investors

Despite the potential risks, the US election stock market also presents opportunities for investors. Here are some strategies to consider:

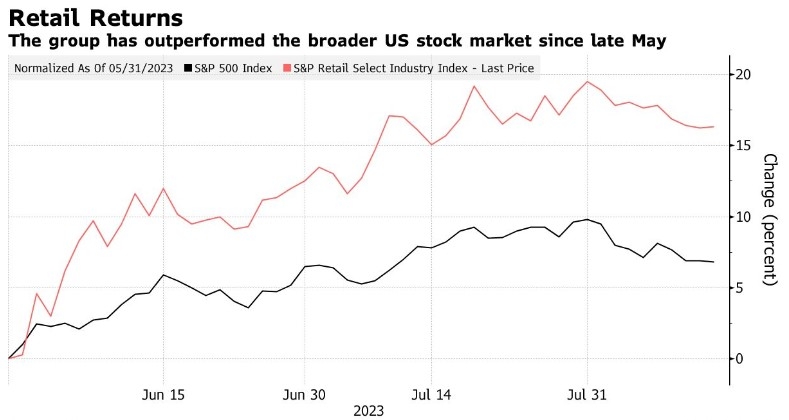

- Sector Rotation: Investors may want to consider shifting their investments to sectors that are likely to benefit from specific policy changes or economic conditions.

- Dividend Stocks: Companies with strong fundamentals and reliable dividends can be a good hedge against market volatility.

- International Exposure: Investing in international markets can provide diversification and potentially capitalize on different economic conditions.

Case Studies

To illustrate the impact of the US election stock market, let's consider two recent examples:

- 2016 Election: The stock market experienced significant volatility in the lead-up to the 2016 election, but ended the year with gains. This can be attributed to the Federal Reserve's decision to keep interest rates low and the strong performance of the technology sector.

- 2020 Election: Despite the uncertainty surrounding the 2020 election, the stock market ended the year with gains. This can be attributed to the Federal Reserve's aggressive monetary policy and the rollout of COVID-19 vaccines.

Conclusion

The US election stock market is a complex and dynamic relationship that requires careful analysis and understanding. While the upcoming election presents potential risks and opportunities, investors who stay informed and adopt a diversified approach can navigate the market effectively.

new york stock exchange