Total Value of US Stocks: A Comprehensive Overview"

author:US stockS -

In today's dynamic financial landscape, understanding the total value of US stocks is crucial for investors and market enthusiasts. This article delves into the current state of the US stock market, highlighting key trends, factors influencing stock prices, and potential investment opportunities.

The Current State of US Stocks

The total value of US stocks has been on a steady rise over the past few years, driven by factors such as economic growth, technological advancements, and favorable monetary policies. As of the latest data, the total value of US stocks has reached an all-time high, surpassing $40 trillion.

Key Trends in the US Stock Market

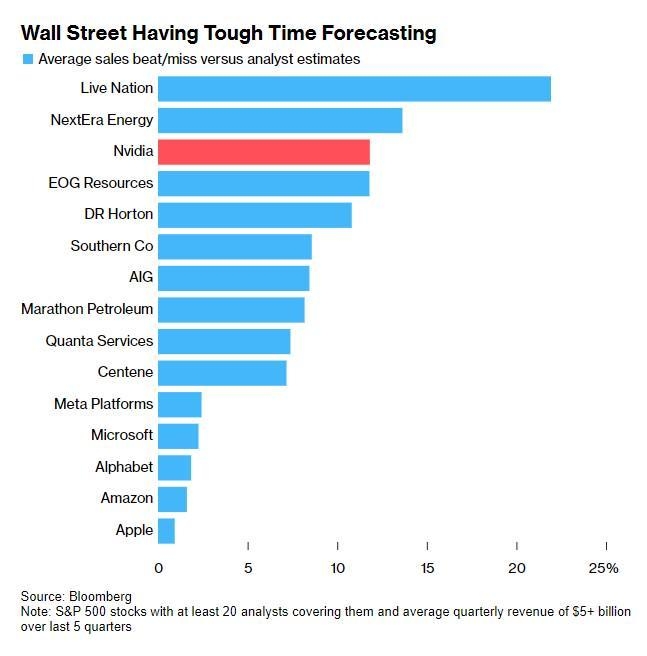

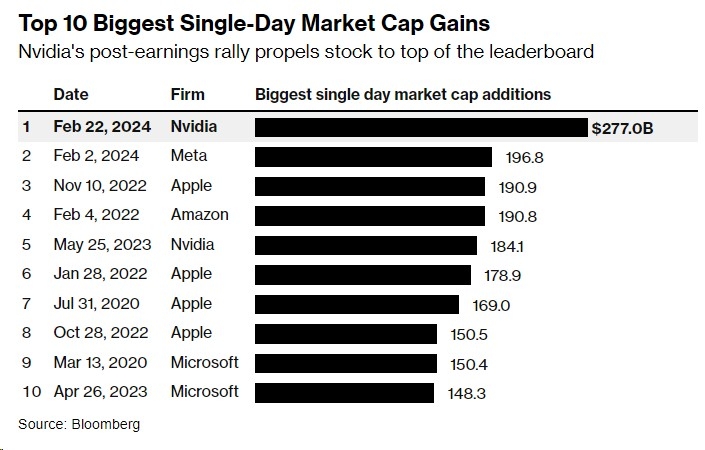

Tech Stocks Domination: The tech sector has been a major driving force behind the increase in the total value of US stocks. Companies like Apple, Microsoft, and Amazon have seen their market capitalization soar, contributing significantly to the overall value.

Rising Valuations: With the stock market's continuous upward trend, valuations have also risen. However, some experts caution that this could lead to a potential bubble in the market.

Diversification: Investors are increasingly focusing on diversifying their portfolios to mitigate risks. This trend has led to a rise in interest in sectors like healthcare, energy, and consumer goods.

Factors Influencing Stock Prices

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation rates play a crucial role in influencing stock prices. Positive economic indicators generally lead to higher stock prices, while negative indicators can have the opposite effect.

Monetary Policy: The Federal Reserve's monetary policy decisions, including interest rate changes, have a significant impact on the stock market. Lower interest rates tend to boost stock prices, while higher rates can have the opposite effect.

Political Factors: Political events, such as elections or policy changes, can also influence stock prices. For example, the recent trade tensions between the US and China have had a notable impact on the stock market.

Potential Investment Opportunities

Given the current state of the US stock market, investors can consider the following opportunities:

Tech Stocks: Investing in leading tech companies can offer significant returns, but it's important to do thorough research and understand the associated risks.

Dividend Stocks: Dividend stocks provide investors with regular income and can be a good way to diversify their portfolios.

Emerging Sectors: Investing in emerging sectors like renewable energy and healthcare can offer long-term growth potential.

Case Study: Apple Inc.

Apple Inc. is a prime example of a company that has contributed significantly to the total value of US stocks. Over the past decade, Apple's market capitalization has grown exponentially, making it one of the most valuable companies in the world. This growth can be attributed to its innovative products, strong brand, and efficient management.

In conclusion, understanding the total value of US stocks is essential for anyone interested in the financial markets. By keeping an eye on key trends, factors influencing stock prices, and potential investment opportunities, investors can make informed decisions and maximize their returns.

new york stock exchange