Title: Understanding the Average P/E Ratio of US Stocks

author:US stockS -

The price-to-earnings (P/E) ratio is a vital metric for investors seeking to gauge the value of a company. By examining the average P/E ratio of US stocks, we can gain insights into market trends and investment opportunities. In this article, we'll delve into what the average P/E ratio signifies and how it can impact your investment decisions.

What is the Average P/E Ratio?

The P/E ratio is calculated by dividing the stock price by the company's earnings per share (EPS). This ratio provides a quick assessment of how much investors are willing to pay for each dollar of a company's earnings. For instance, if a stock has a P/E ratio of 20, it means investors are willing to pay

The average P/E ratio of US stocks fluctuates over time, reflecting market conditions and investor sentiment. A high average P/E ratio suggests that investors have a positive outlook on the market and are willing to pay a premium for stocks. Conversely, a low average P/E ratio indicates that investors are concerned about the market's future and are seeking value investments.

Market Trends and Investment Opportunities

Understanding the average P/E ratio of US stocks can help investors identify market trends and potential investment opportunities. Here are a few key insights:

Historical Context: Over the past few decades, the average P/E ratio of US stocks has ranged from 10 to 30. A P/E ratio below 10 may indicate undervalued stocks, while a P/E ratio above 30 may suggest overvalued stocks.

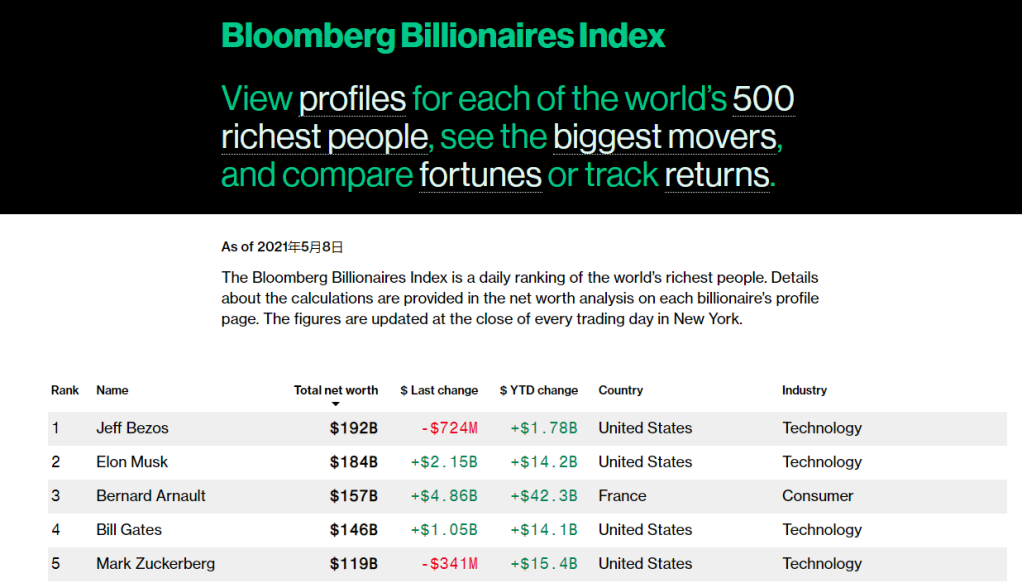

Sector Differences: Different sectors exhibit varying average P/E ratios. For example, technology stocks often have higher P/E ratios than utilities or consumer staples. Investors should consider sector-specific P/E ratios when analyzing their portfolios.

Economic Indicators: Economic indicators, such as interest rates and GDP growth, can influence the average P/E ratio. In times of economic expansion, the average P/E ratio tends to rise, while during recessions, it may fall.

Market Cycles: The average P/E ratio follows market cycles. During bull markets, the average P/E ratio tends to rise, while during bear markets, it may fall. Understanding these cycles can help investors time their investments more effectively.

Case Study: The Tech Sector

Let's take a closer look at the tech sector to illustrate the impact of the average P/E ratio. In the late 1990s, the tech sector experienced a bubble, leading to an average P/E ratio of over 100. When the bubble burst, the average P/E ratio plummeted to around 25. Today, the tech sector's average P/E ratio hovers around 40, reflecting a healthy balance between growth and value.

By analyzing the average P/E ratio of US stocks, investors can gain a better understanding of the market and identify potential opportunities. However, it's crucial to conduct thorough research and consider various factors before making investment decisions.

In conclusion, the average P/E ratio of US stocks is a valuable tool for investors looking to gauge market trends and investment opportunities. By understanding this metric and its implications, investors can make more informed decisions and potentially achieve better returns.

new york stock exchange