Title: US Bank Stocks Today: A Comprehensive Analysis

author:US stockS -

Introduction: In today's dynamic financial landscape, keeping a pulse on the performance of bank stocks is crucial for investors. This article delves into the current state of US bank stocks, providing an in-depth analysis of key trends, performance indicators, and potential investment opportunities. By examining the financial health, growth prospects, and market dynamics of leading banks, we aim to offer valuable insights for investors looking to navigate the ever-evolving banking sector.

Performance Indicators:

To gauge the current state of US bank stocks, it is essential to consider various performance indicators. These include:

Earnings Per Share (EPS): EPS measures a bank's profitability by dividing its net income by the number of outstanding shares. A rising EPS indicates improving profitability.

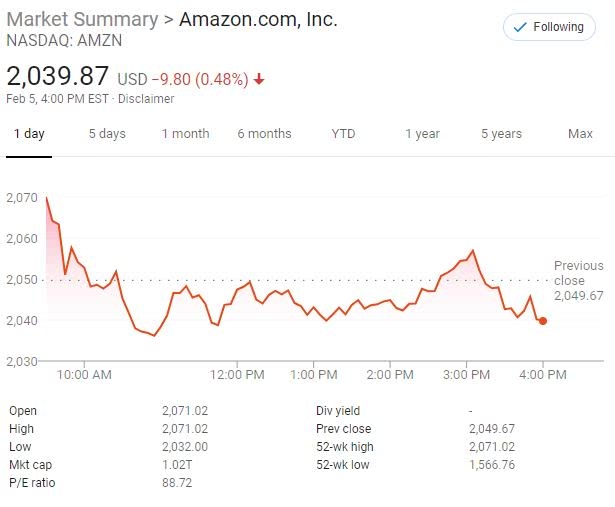

Price-to-Earnings (P/E) Ratio: The P/E ratio compares a bank's stock price to its EPS. A lower P/E ratio suggests that the stock may be undervalued, while a higher ratio may indicate overvaluation.

Return on Equity (ROE): ROE measures a bank's profitability by dividing its net income by its shareholders' equity. A higher ROE suggests that a bank is effectively utilizing its equity to generate profits.

Dividend Yield: The dividend yield represents the annual dividend payment as a percentage of a bank's stock price. Higher dividend yields can be attractive for income-focused investors.

Top US Bank Stocks:

Several US bank stocks have stood out in recent times. Here are a few notable examples:

JPMorgan Chase (NYSE: JPM): As one of the largest banks in the US, JPMorgan Chase has demonstrated strong financial performance and stability. The bank has a robust presence in various segments, including consumer banking, corporate banking, and investment banking.

Bank of America (NYSE: BAC): Bank of America is another prominent player in the US banking sector. The bank has a diversified business model, with a strong focus on consumer banking, global markets, and wealth management.

Wells Fargo (NYSE: WFC): Although Wells Fargo has faced some challenges in the past, the bank has made significant strides in improving its operations. The bank offers a wide range of financial services, including consumer banking, commercial banking, and wealth management.

Market Dynamics:

The US banking sector is influenced by various factors, including economic conditions, regulatory changes, and technological advancements. Here are some key market dynamics to consider:

Economic Growth: A strong economy can lead to higher loan demand and improved profitability for banks. Conversely, a recession can have a negative impact on bank performance.

Regulatory Environment: Changes in regulations can affect the profitability and operations of banks. For instance, higher capital requirements or stricter lending standards can limit banks' growth prospects.

Technological Advancements: The rise of fintech companies and digital banking solutions has created new challenges and opportunities for traditional banks. Banks that can adapt to these changes are likely to thrive in the long run.

Conclusion:

Understanding the current state of US bank stocks is crucial for investors looking to capitalize on the sector's potential. By analyzing key performance indicators, top bank stocks, and market dynamics, investors can make informed decisions regarding their investments. As the banking sector continues to evolve, staying informed and adapting to market changes will be key to success.

new york stock exchange